United Bank for Africa Plc (UBA) has unveiled its 2023 half-year financial report, showing a meteoric rise in profit.

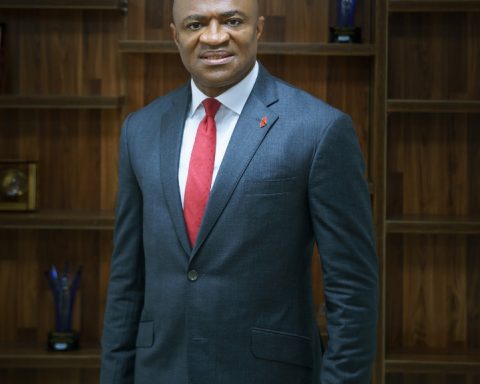

“We’re witnessing a remarkable transformation here,” said Oliver Alawuba, the group managing director/chief executive officer at UBA, as he spoke of the bank’s results.

Join our WhatsApp Channel“Our H1 2023 performance has left us in awe, and it’s not just about the numbers; it’s about the unwavering commitment and resilience of our team,” he added.

According to the report, UBA recorded a profit after tax of N378.2 billion in the first half of 2023, marking a 437.8 percent leap from the N70.33 billion recorded in the same period the previous year.

READ ALSO: Nigeria Destroying Illegal Refineries, Yet No Legal Refinery

“Let me put that in perspective,” Alawuba continued. “It’s like going from a brisk walk to a supersonic flight in just one year.”

The bank’s profit before tax also rose to N404 billion, which is 371 percent increase compared to the N85.6 billion recorded in H1 2022. This translated into an annual return on average equity of 57.7 percent, up from a comparatively modest 17.1 percent a year earlier.

“The group recorded strong double-digit growth in revenues and profits from its operations,” Alawuba declared, attributing part of this remarkable success to “sizable revaluation gains arising from the harmonization of currency exchange rates in Nigeria.”

In the same vein, analysts at Cordros Securities noted that UBA’s H1 results mirrored the earnings growth seen across its tier 1 peers, primarily thanks to the foreign exchange liberalization implemented during the same period.

“We envisage this strong earnings growth to remain by year-end, driven by the combined impact of elevated interest rates and naira devaluation in the period,” they confidently predicted.

Here are some of the standout figures from UBA’s financial statement:

Core Activity Revenue Soars:

UBA’s interest income from core activities experienced a staggering 66.4 percent growth, reaching N428.3 billion, up from N257.4 billion. This monumental growth was spurred by interest income on investment securities and cash and bank balances, according to analysts from CSL Stockbrokers.

“UBA’s H1 ’23 audited numbers showed a strong 66.4 percent year-on-year growth in Interest Income to N428.3 billion driven mainly by a significant growth in interest income on investment securities and on cash and bank balances,” they reported.

Non-Interest Income in the Stratosphere:

The group’s non-interest income witnessed an astronomical surge, skyrocketing by 544.2 percent to N505.9 billion from N78.5 billion. This remarkable growth can be attributed to higher income generated from FX revaluation gains (N29.2 billion), net fees and commissions (N78.3 billion), and investment securities trading (N25.4 billion).

Cash and Cash Equivalent Prowess:

Cash and cash equivalents increased to N1.1 trillion from N960.8 billion, driven by a staggering 320.8 percent rise in net cash generated from operating activities, reaching N2 trillion compared to N477.5 billion. Net cash used in investing activities recorded a negative cash flow of N1.9 trillion, while net cash used in financing activities amounted to N215.2 billion in H1 ’23.

Impairment Charges Surge:

Impairment charges experienced significant growth, reaching N153.9 billion compared to N8.3 billion. This brought the H1 annualized cost of risk to 7.7 percent, contrasting with 0.6 percent. According to CSL, this increase in impairment charges can be partially attributed to the impact of devaluation on impairments related to FX loans.

Earnings Per Share Skyrockets:

UBA’s earnings per share saw substantial growth, rising to N10.95 per share from N1.98 per share. Experts are hailing this as a remarkable testament to the bank’s financial prowess and its commitment to shareholder value.

In an industry known for its unpredictability, UBA’s astonishing H1 2023 results have left stakeholders and competitors alike astounded, underlining the bank’s unwavering position as a dominant force in the Nigerian and global financial landscape

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.