KPMG, professional services firm, has warned that Nigeria’s debt burden could result in critical debt servicing problems during the administration of Bola Tinubu.

In a report on Thursday, 18 May, KPMG said by the end of 2023, Nigeria’s debt profile will hit N77.8 trillion due to the approval of the N22.7 trillion Ways and Means advances the Central Bank of Nigeria (CBN) handed the Federal Government.

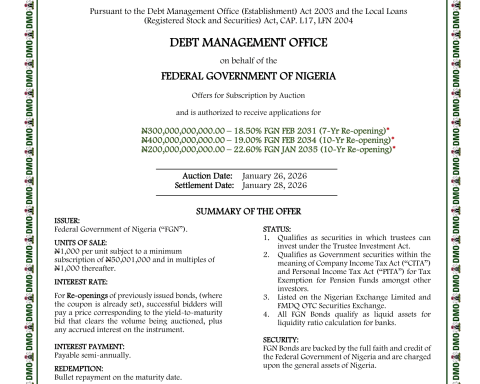

Join our WhatsApp ChannelThe firm also factored in the budgeted N8.8 trillion expected new borrowings to be sourced from both domestic and external creditors. This will raise the debt profile put at N46.3 trillion by the end of 2022 to N77.8 trillion.

KPMG said the increase will force the government to spend 100 per cent of its revenue on debt servicing, making it impossible for the next administration taking over on May 29 to fund operations and functions.

Consequently, the new administration will be compelled to borrow more to finance government activities to stimulate growth.

Note that the World Bank’s debt service-to-revenue ratio for developing countries like Nigeria is 22.5 per cent, but Nigeria’s ratio was 80.6 per cent in 2022.

“With FGN revenue to GDP ratio of 4.49% as of December 2022, Nigeria’s debt service to revenue ratio may surpass 100% in 2023, which will limit the fiscal space and the government’s ability to pay for its operations and functions, unless urgent measures are taken to build revenue,” KPMG said.

“This is however unlikely being a transition year with the outgoing administration winding done and a new one starting which would require time to set up and settle before new policies can be introduced and work.”

The need to borrow more funds to run the government will force Tinubu’s administration to lift or review the legal and self-imposed restraints placed on deficit financing, which rose from N1.62 trillion in 2015 to N10.78 trillion in 2023 during the outgoing administration of President Muhammadu Buhari.