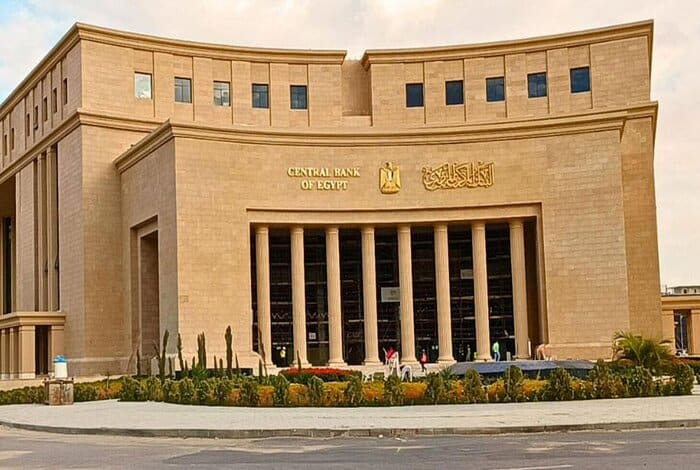

Egypt’s Central Bank (CBE) has launched the website for Haweya, the country’s first national digital identity platform, which enables citizens to verify and utilize their digital identity for banking and government transactions.

The launch is part of Egypt’s plan to transition to a cashless economy based on secure electronic services via mobile, aligning with the country’s Vision 2030 goals. The platform employs electronic Know Your Customer technology to create verified digital identities. Once registered, users can open bank accounts electronically from home, verify official documents digitally, conduct government transactions online, and access various service providers without physical presence at bank branches.

With a population of approximately 118.4 million people, Egypt ranks as the 13th most populous country globally, making Haweya one of the largest digital identity rollouts in the developing world. The platform will serve 37 banks operating across the country.

Join our WhatsApp ChannelFinancial inclusion rates in Egypt reached 76.3% as of June 2025, with 53.8 million citizens out of 70.5 million adults now owning active accounts for financial transactions. This represents a 214% increase since 2016, demonstrating the country’s rapid progress toward digital financial services.

The initiative places Egypt among several Middle Eastern nations pursuing digital identity platforms. The UAE’s national digital identity app, UAE Pass, uses AI-powered facial recognition to allow citizens to access thousands of government and private services. Saudi Arabia’s Nafath platform enables users to verify identity using facial biometrics, with the Ministry of Interior having issued 28 million digital identities.

READ ALSO: Egypt’s Net Foreign Assets Slip to $17.9 Billion in August Amid Strong Deposit Growth

Egypt enacted Law No. 151 of 2020, the Personal Data Protection Law, which aligns with international frameworks like the European Union’s GDPR. The law establishes clear standards for consent, data processing, and user rights as the country expands its digital identity ecosystem.

Egypt has positioned financial inclusion among its top priorities as part of the 2030 Vision goals to support small and medium enterprises, formalize the informal sector, raise employment rates, and achieve sustainable economic growth. The country also aims to launch a digital currency issued by the Central Bank by 2030, seeking to raise the number of digital financial wallets to about 80 million.

John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee

- John Adoyi, PBA Journalism Mentee