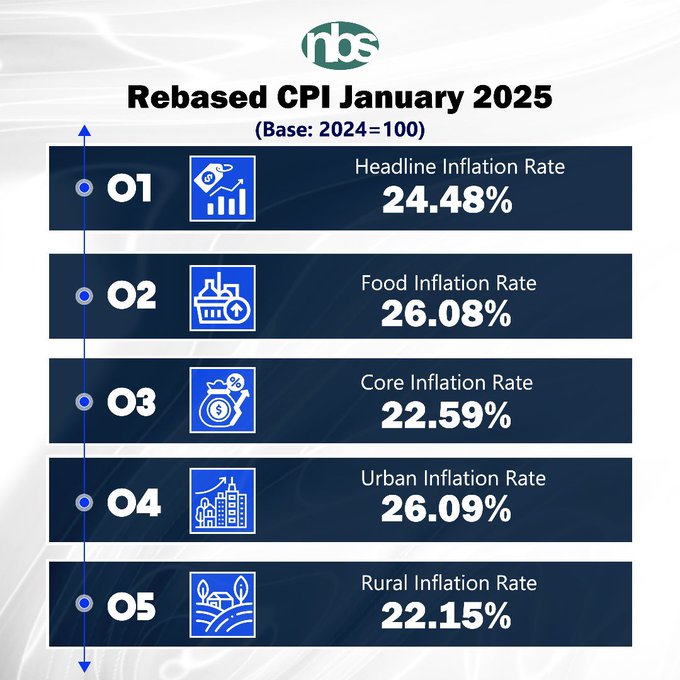

Nigeria’s headline inflation rate dropped significantly to 24.48% In January 2025, marking a notable decrease from the 34.80% recorded in December 2024. The decline in inflation comes as a relief to many Nigerians grappling with the high cost of living and economic instability.

Inflation Rates Decline Significantly

The new inflation data was released by the National Bureau of Statistics (NBS). Adeyemi Adeniran, the Statistician-General of the Federation, shared the details during a briefing in Abuja on Tuesday. He revealed that the Consumer Price Index (CPI), which measures changes in the prices of goods and services, had fallen to 24.48% year-on-year for January.

Join our WhatsApp ChannelREAD ALSO: Interesting Things To Know Ahead Of Rebased Inflation Figures

Adeniran also highlighted that inflation levels varied across different regions in Nigeria. Urban inflation stood at 26.09%, while rural inflation was slightly lower at 22.15%. This disparity reflects the different economic challenges faced in urban and rural areas.

CPI Rebased to Reflect Current Trends

A major factor contributing to the decline in inflation was the rebasing of the CPI. Adeniran explained that the rebasing was necessary to ensure that inflation data remains aligned with international standards and reflects the current economic realities. The rebasing involved updating the reference year used to calculate inflation, which also adjusted the basket of goods and services measured in the CPI.

The adjustment helps ensure that inflation data better captures current consumer spending habits. This update is vital for policymakers, as it allows them to create more accurate and effective economic strategies.

Food Inflation Also Declines

One of the most significant components of Nigeria’s inflation is food inflation. In January 2025, food inflation dropped to 26.08% year-on-year, a decrease from 39.84% in December 2024. This decline in food inflation suggests a reduction in the rising costs of essential food items, which have been a major concern for Nigerian families over the past year.

The drop in food inflation is encouraging, but many Nigerians are still feeling the impact of high prices, especially in rural areas where access to affordable food can be more limited.

Core Inflation Also Drops

Alongside food inflation, Nigeria’s core inflation, which excludes volatile agricultural products and energy prices, also saw a decline. In January 2025, the core inflation rate was 22.59%, down from previous levels. This decrease reflects a reduction in the general cost of goods and services excluding food and energy, which can fluctuate significantly.

Core inflation is an important indicator as it shows the underlying inflationary pressures in the economy. A drop in core inflation suggests that price increases in sectors outside of food and energy are also slowing down, offering some relief to Nigerians.

Efforts to Control Inflation and Stabilize the Economy

The Central Bank of Nigeria (CBN) has been actively working to curb inflation and stabilize the economy. Governor Yemi Cardoso has emphasized the importance of tackling inflation through both fiscal and monetary policies. In a statement earlier in the month, Cardoso reaffirmed the CBN’s commitment to reducing inflation and improving the purchasing power of Nigerians.

“Managing disinflation amidst persistent shocks requires not only robust policies but also coordination between fiscal and monetary authorities to anchor expectations and maintain investor confidence,” Cardoso said during a Monetary Policy Forum 2025 in Abuja.

The CBN has been focused on managing inflationary pressures and transitioning towards an inflation-targeting framework. This strategy is aimed at restoring purchasing power and easing the economic hardship faced by many Nigerians.

Challenges Ahead for Nigeria’s Economy

Despite the decline in inflation, Nigeria’s economy continues to face significant challenges. The persistent rise in inflation has led to a decrease in the purchasing power of Nigerians, making it harder for families to afford basic goods and services. The CBN’s efforts to stabilize inflation will require ongoing coordination with other economic agencies and policy measures to reduce the impact on the population.

While the drop in inflation is a positive development, it is clear that more work is needed to bring inflation down to more manageable levels and address the broader economic issues facing the country.

Inflation Remains a Priority for Policy Makers

As inflation continues to be a key concern for Nigerians, policymakers will need to stay focused on finding ways to control price increases while supporting economic growth. The recent inflation figures provide a hopeful sign, but there is still much work to be done to ensure that Nigerians can benefit from more stable and affordable prices in the future.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.