The Economic and Financial Crimes Commission (EFCC) has successfully opposed the bail application of Tigran Gambaryan, an executive of Binance Holdings Limited, citing a high risk of flight.

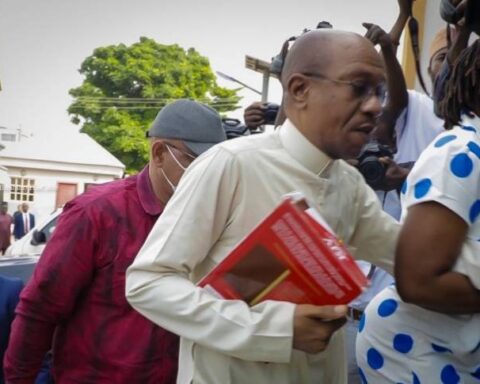

Gambaryan is being prosecuted alongside his colleague, Nadeem Anjarwalla, and Binance Holdings Limited on money laundering charges.

EFCC prosecutor, Emeka Iheanacho, argued that Gambaryan’s attempt to obtain a new passport while his existing one was in custody suggested a plan to escape Nigeria. Additionally, the recent escape of Anjarwalla to Kenya while on bail has raised concerns about Gambaryan’s potential flight risk.

Iheanacho emphasized that granting bail to Gambaryan would be a “grave risk” and urged the court to deny the application. He stated, “This court will be taking a grave risk to grant the defendant bail. This is also because he has no attachment to any community in Nigeria.”

Gambaryan’s lawyer, Mark Mordi (SAN), countered that his client’s continued detention was “purely a state-sanctioned hostage taking” and argued that there was no evidence to suggest he was a flight risk. Mordi stated, “He can’t go anywhere. They (EFCC) have his passport. Already, being here, unable to go meet his family, is enough torture.”

Justice Emeka Nwite has adjourned the ruling on the bail application until May 17. The EFCC’s opposition to Gambaryan’s bail application highlights the agency’s determination to prevent high-profile defendants from fleeing the country while facing trial.

The case against Gambaryan, Anjarwalla, and Binance Holdings Limited centers on allegations of money laundering and concealing the source of $35,400,000 in revenue generated by Binance in Nigeria. The EFCC accuses the defendants of knowing that the funds constituted proceeds of unlawful activity.