The Debt Management Office (DMO) said petrol subsidy is reducing Nigeria’s revenue and increasing Nigeria’s debt, which rose from N39.56 trillion recorded at the end of December 2021, to N41.6 trillion at the end of first quarter 2022.

Nigeria’s debt – the total public debt – increased by N2.04 trillion within three months, with the country’s revenue one of the lowest ratio to GDP, which is 6.3 percent, and ranks Africa’s largest economy on 194 spot out of 196 countries on the list of revenue to GDP ratio.

Join our WhatsApp ChannelREAD ALSO: DMO Says Bank Savings Unattractive, As FG Slashes Bonds Investment To N5,000

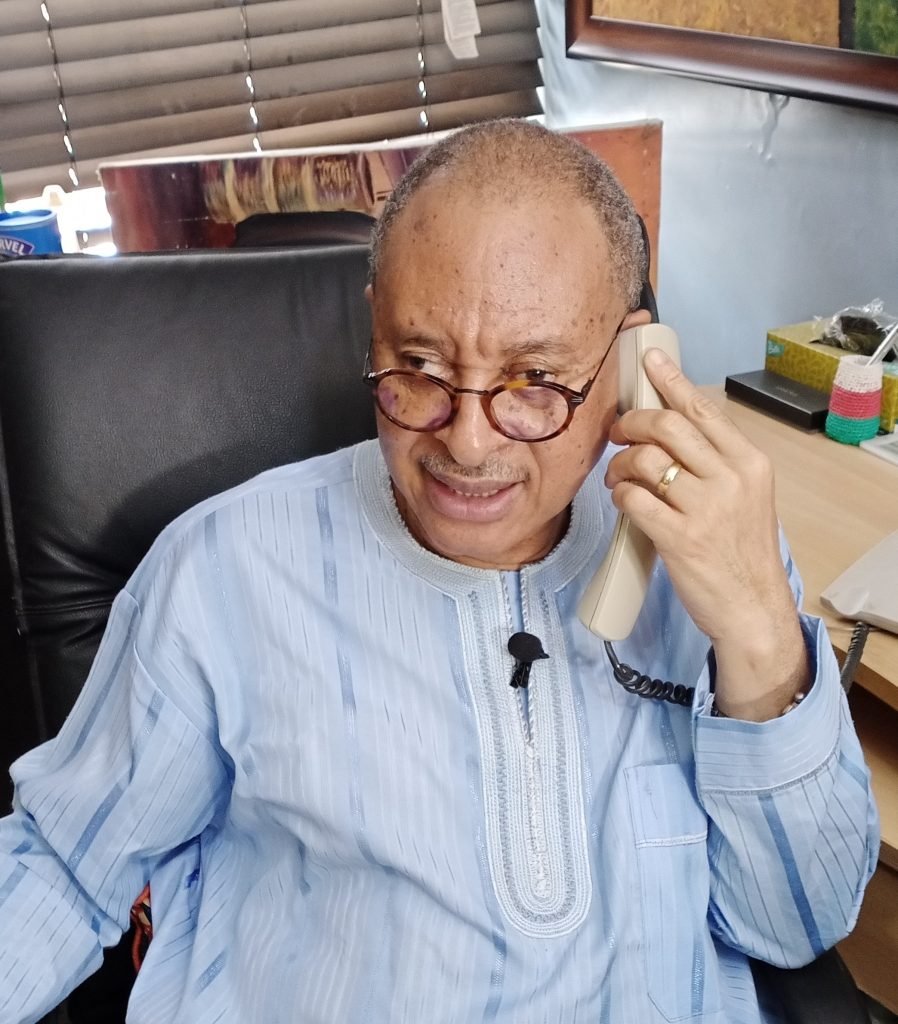

According to the DMO’s Director-General, Patience Oniha, addressing petrol subsidy, insecurity, ramping up crude oil production, ending crude oil theft, as well as curbing soaring inflation will help increase Nigeria’s revenue, and reduce the country’s dependent on loan.

Nigeria’s debt office said: “The DMO has continuously maintained its position on the need to raise revenue.” Explaining further that, “One issue to be addressed is the petrol subsidy which has significantly increased annual budget deficits and ultimately, increased the level of new borrowings and the public debt stock.

“There is a vital need to ramp up crude oil production and end crude oil theft and pipeline vandalism to meet oil revenue targets, especially in the light of rising crude oil prices.

“Other structural issues such as insecurity, inflation, infrastructural deficit and foreign exchange shortages adversely affecting the business environment need to be resolved.” Oniha told NAN on Wednesday.

On Nigeria’s debt, the DMO DG also said relative to other countries, statistics shows that Nigeria’s revenue is low, and the “World Bank’s World Economic Outlook for 2020 showed that Nigeria with revenue to GDP ratio of 6.3 percent was ranked at 194 out of 196 countries covered.

“The DMO has repeatedly emphasised the need to grow revenues significantly in order for a debt to be sustainable.

“It is advisable for the media and public analysts to begin to focus attention on Nigeria’s revenue generation.

“Revenue is the way to go and that is how countries develop and use borrowing to augment revenue shortfalls now and again.

“Nigeria has been running budget deficits for decades; it is about time to shift to balanced budgets and even surplus budgets.” She said.

According to Oniha, Nigerian government have had to borrow in place of low revenue, and insecurity, as well as the pandemic had eaten into the finances of the government, “Public debt has grown over the last years as the government borrowed to meet major revenue shortfalls, increased spending on security and infrastructure, as well as funding on health due to the COVID-19 pandemic.” The DMO chief said.

She added that, “The levels of new borrowing to meet these needs are often captured in the annual appropriation acts and medium-term external borrowing plan (MTEBP).

“Although it looks obvious, one of the things omitted in the analyses by experts is that new borrowing will automatically translate to higher debt stock and debt service levels.”