By Sahndra Fon Dufe Okeowo

As the Silicon Valley African Film Festival (SVAFF) celebrated its 15th anniversary, it continued to serve as a powerful platform for amplifying the rich tapestry of African cinema.

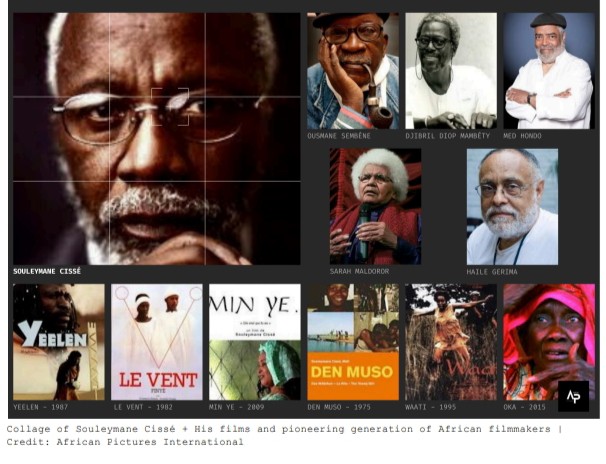

This year’s theme, “Amplifying African Voices in Global Cinema,” resonated deeply, especially in the wake of the Icons Awards ceremony held on Sunday, October 13th, where the legendary filmmaker Souleymane Cissé was honored. At 84, Cissé stands as a monumental figure in African cinema—a living testament to the rich history and evolution of storytelling from the continent. He is indeed one of the last remaining elders, making it a significant honor to celebrate him.

Join our WhatsApp Channel

During the ceremony, Cissé shared a poignant message for both emerging and established filmmakers: “We need to look back and learn from what those of us before did.” His words served as a clarion call for the next generation to recognize the foundational work laid down by pioneers like himself, Ousmane Sembène, Djibril Diop Mambéty, Med Hondo, Sarah Maldoror, and Haile Gerima. As he sat alongside these cinematic giants, one could feel the reverence in the room, with fellow icon Dash herself visibly starstruck by his presence. It is a rare opportunity to engage with a filmmaker who has shaped the narrative landscape of Africa.

Born on April 21, 1940, Cissé belongs to a pioneering generation of African filmmakers who emerged in the post-colonial period, focusing on African identity, history, and culture through cinema. Other notable filmmakers from his era include:

- Ousmane Sembène (Senegal) – Often referred to as the “father of African cinema,” he passed away in 2007.

- Djibril Diop Mambéty (Senegal) – Known for his avant-garde films, especially Touki Bouki and Hyenas, he passed away in 1998.

- Med Hondo (Mauritania) – A revolutionary filmmaker whose work tackled colonialism and migration, he passed away in 2019.

- Sarah Maldoror (France/Angola) – A pioneering woman in African cinema known for Sambizanga, she passed away in 2020.

- Haile Gerima (Ethiopia) – Known for films like Sankofa and Teza, Gerima is still active today.

Credit: African Pictures International.

Cissé’s insights remind us of the importance of heritage in filmmaking. His work, which often focuses on themes of identity, history, and culture, has paved the way for new voices to emerge and flourish. As the current president of FESPACO, the prestigious Pan-African Film and Television Festival of Ouagadougou, Cissé is dedicated to nurturing upcoming talent, ensuring that African narratives continue to resonate on a global scale.

Souleymane Cissé’s voice has significantly contributed to amplifying African narratives on the global stage by showcasing the depth and richness of the continent’s stories, inviting international audiences to engage with African culture profoundly. His pioneering films, such as Yeelen (which captivated audiences at Cannes), reflect a stark and beautiful visual style that marries traditional storytelling with cinematic innovation. This mastery has paved the way for a new generation of filmmakers, including notable directors like Abderrahmane Sissako, whose work continues to resonate worldwide; Wanuri Kahiu, known for her bold explorations of contemporary themes; and Haile Gerima, who keeps the legacy of African storytelling alive through his thought-provoking narratives. Cissé didn’t merely walk the path—he ran, creating a legacy that inspires others to reclaim their narratives amidst the distractions of modern cinema. His journey raises the question: will someone revive that strikingly beautiful style that once captured the world’s imagination?

READ ALSO: Oscars 2024: ‘American Fiction’ Wins Best Adapted Screenplay

Alessandra

The festival also proudly honored a distinguished lineup of filmmakers, including John Kani, RMD, and Julie Dash, alongside the legendary Souleymane Cissé. This momentous occasion, orchestrated by the visionary founder Chike Nwoffiah, celebrated not just individual achievements but also the collective spirit of African cinema. As Cissé, a titan of the industry, took the stage, his presence served as a poignant reminder of the rich legacy that these filmmakers represent. Each honoree, from Kani’s profound wisdom to Dash’s trailblazing contributions, underscores the depth and diversity of African narratives. In this vibrant gathering, the legacy of African cinema was both honored and invigorated, inspiring a new generation to carry the torch forward.

Icon Award Night| Image: Asha Alessandra

READ ALSO: 12 African cities vying for the most culturally vibrant on the continent.

With 85 films from 38 countries on the program, SVAFF 2024 was a powerful showcase of diverse storytelling and cinematic talent. The festival brought together filmmakers from across the globe, celebrating African narratives with a rich lineup of films and cultures. Young talent was also recognized as 21-year-old Ozie Nzeberibe won the Trailblazer Award, recognizing his rising talent in African cinema.

As the festival closed, it was clear that African cinema’s future is bright, built on a foundation of history, wisdom, and boundless creativity. The celebration of Cissé and his contemporaries stood as a powerful call to action for future filmmakers: to carry forward the legacy of storytelling, amplifying African voices on the global stage.

Follow Us