Emir of Kano, Alhaji Aminu Ado Bayero, has expressed delight with the arrival of The Alternative Bank in Kano, a faith-based financial institution, which opened its first stand-alone branch in Northwest Nigeria’s ancient city.

Emir Bayero described the Kano office opening as “transformative”, just as the bank described itself as highly ‘ethical.’

According to the Emir, the Alternative Bank is a transformative force that will significantly impact individuals and businesses in Kano State.

Bayero declared that the bank’s presence in Kano would mark the dawn of a revolutionary era in banking and a transformative shift in Kano’s financial landscape.

He noted the crucial role that financial institutions play in shaping contemporary society.

According to Bayero, the bank depicts an obligation that goes beyond profit margins. He, therefore, urged the Kano community to support the bank based on its dedication to ethical banking practices.

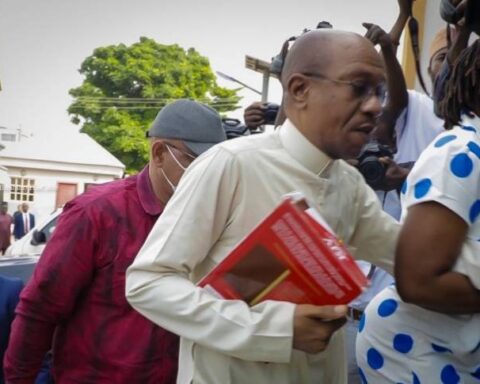

Executive Director of the bank, Garba Mohammed, described the bank as ethical. “We are proud to be part of this remarkable event to flag off the commencement of this bank, which will no doubt be of great service to our people,” Mohammed said.

The executive director revealed that the bank’s investment decisions “adhere to the highest ethical standards”, being unique in sharing profits with customers and highlighting a shared prosperity approach.

“The Alternative Bank aspires to be a force for positive change, channelling resources into projects that uplift communities, empower individuals, and contribute to the greater good,” the executive director said.

“Our dedication to responsible and sustainable banking ensures a focus on long-term prosperity while minimising adverse effects on the environment and society.”

According to Mohammed, “Experts opine that this system of banking is the best alternative to conventional banking, considering the challenges faced by other banks, which are absent in ethical banking.”

Moreover, he pointed out that the bank’s appeal extends to everyone regardless of faith due to factors that simplify business operations. Mohammed called on the community to embrace the bank, adhering to Islamic teachings regarding the banking system.

Established in 2014 as Sterling Bank Alternative Finance, The Alternative Bank has since obtained a licence from the Central Bank of Nigeria to operate as a non-interest banking institution. Over the years, it has evolved to become a leading player in Nigeria’s non-interest banking sector.

What Emir Of Kano Said About Islamic Bank That ‘Shares Profit With Customers’