The United Arab Emirates’ private investments in Nigeria have soared to $375.01 million since the imposition of a visa ban in October 2022, according to the latest Capital Importation report from Nigeria’s National Bureau of Statistics.

Despite diplomatic efforts and conflicting official statements, UAE investors have increased their stakes in the country.

Join our WhatsApp Channel“This significant surge in investments highlights the continued interest of UAE investors in Nigeria’s market,” noted an expert on foreign investments, commenting on the notable 56.51% rise from $164.97 million in the first three quarters of 2022 to $258.2 million between January and September 2023.

The visa ban, affecting not only Nigeria but also several other African countries, had initially caused concerns among trade partners and travel agents, impacting economic activities.

READ ALSO: UAE Pledges $4.5 Billion To Fund Renewable Energy Projects Across Africa

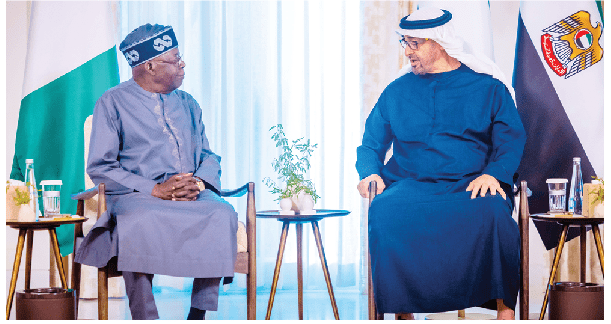

Efforts by both former President Muhammadu Buhari and President Bola Tinubu to lift the blanket visa ban faced obstacles, with conflicting reports on agreements and subsequent denials by UAE officials.

In an unexpected turn, the data also revealed a 663.5% surge in foreign capital from Niger Republic to Nigeria, a notable increase compared to previous quarters.

This surge marks a shift in capital inflow trends, showing emerging patterns in Nigeria’s foreign investments beyond conventional partners.

Despite the diplomatic hurdles and misleading statements, Nigeria seems to attract increased foreign investments, signaling its resilience in the eyes of international investors. This shift in investment trends and the country’s economic relations with neighboring nations could potentially reshape its investment landscape in the foreseeable future.

Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi

- Emmanuel Ochayi