Trump’s Energy Strategy Raises Alarm for Nigeria

The return of Donald Trump as the 47th president of the United States brings renewed focus on his “America First” energy strategy, which could have significant implications for oil-dependent nations like Nigeria. As discussions unfold, experts warn that Nigeria may face economic challenges similar to those experienced during Trump’s previous tenure.

“Trump’s policies may seem like a domestic agenda, but the ripple effects are global,” says Lukman Otunuga, senior market analyst at FXTM. “For an economy like Nigeria, heavily reliant on oil exports, the consequences of falling oil prices can be catastrophic.”

Join our WhatsApp ChannelTrump’s Oil Tsunami: Will Nigeria Sink Or Swim?

Under Trump’s leadership, U.S. energy policy prioritised domestic production, significantly impacting global oil prices. Aggressive drilling and expedited pipeline construction led to market saturation, driving prices down. Experts expect a similar approach this time, with profound implications for Nigeria.

“Nigeria is currently producing about 1.8 million barrels per day against a budgeted target of over 2 million barrels. Lower oil prices would widen this gap, reducing revenue and foreign reserves,” explains Samson Simon, chief economist at ARKK Economics.

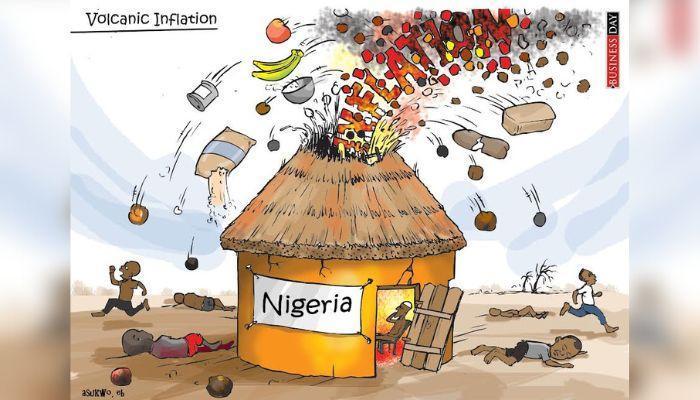

For Nigeria, where oil accounts for 90% of export revenue, this could strain public finances and weaken the naira further. “Inflation will spike as the naira depreciates,” Otunuga adds.

The Risks of Renewed Protectionism

Beyond energy policies, Trump’s protectionist trade stance could also hit Nigeria hard. His previous term introduced tariffs and reduced emphasis on African economies, trends likely to continue.

“Trade concessions like the African Growth and Opportunity Act (AGOA) are at risk. Losing preferential trade terms would be a blow to Nigerian industries that rely on U.S. market access,” says Simon.

READ ALSO: Republican Party Takes Control Of Both Chambers, Paving Way For Trump’s Agenda

Additionally, tighter U.S. immigration restrictions could shrink remittances from the Nigerian diaspora, a critical source of foreign currency. “This would not only reduce household incomes but also further strain foreign reserves,” notes Kingsley Moghalu, former Deputy Governor of the Central Bank of Nigeria.

Strengthening the Dollar and Import Pressures

A Trump-led monetary policy could strengthen the U.S. dollar, adding another layer of difficulty for Nigeria’s import-heavy economy. A robust dollar would increase import costs, exacerbating inflation already driven by high food prices.

“Food inflation is currently at 33.88%, and a stronger dollar would worsen the situation,” says economist Funmi Adeola. “This limits policymakers’ options to mitigate economic shocks in a high-debt environment.”

Calls for Economic Diversification

Experts are unanimous on the need for Nigeria to diversify its economy. Over-reliance on oil leaves the country vulnerable to external shocks, with domestic policies offering limited solutions.

“Trump’s victory should be a wake-up call for Nigeria,” says Moghalu. “The focus should shift to developing other sectors like agriculture, technology, and manufacturing.”

Samson Simon echoes this sentiment: “Economic diversification is no longer an option; it’s a necessity. Building resilience against external shocks is the only way forward.”

The Path Ahead

Trump’s energy policies serve as a reminder of the interconnected nature of global economies. While the U.S. may reap short-term benefits, oil-dependent nations like Nigeria bear the brunt of market shifts.

“It’s time for Nigeria to break free from its oil dependency,” Otunuga concludes. “Only then can it secure a stable and sustainable future, regardless of global economic trends.”

For Nigeria, Trump’s presidency could prove to be a turning point, underscoring the urgent need for robust and diversified economic strategies. Policymakers must act decisively to mitigate risks and lay the groundwork for a more resilient economy.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.