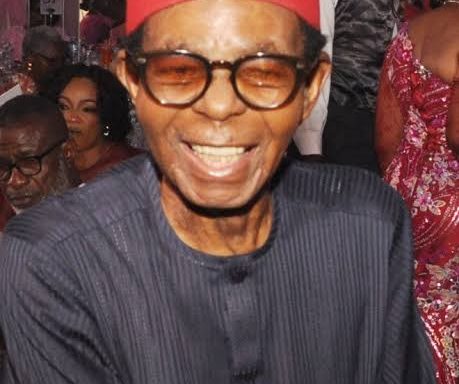

The Chairman of United Bank for Africa (UBA), Tony Elumelu, has bought N560 million worth of shares in the commercial bank through his investment company, HH Capital Limited.

He made the acquisition on Tuesday, 9 May, according to a document released on Wednesday, 10 May, which showed Elumelu bought 70 million shares.

Join our WhatsApp ChannelThis increased his total shares in UBA to 2.45 billion shares, from the 2.38 billion shares he held as of the end of December 2022.

Elumelu now owns 7.16 per cent controlling stake in UBA, which is worth N19.48 billion. He previously held N18.92 billion investment, representing 6.96 per cent.

Prime Business Africa gathered that Elumelu’s shares in UBA are held directly and through several companies; HH Capital Limited, Heirs Holdings Limited and Heirs Alliance Limited.

Elumelu has 194.66 million direct shares, Heirs Holdings Limited accounts for 1,81 billion shares, HH Capital Limited controls 210.84 million shares, and he warehouse 231.08 million shares in Heirs Alliance Limited.

The same day Elumelu bought the shares, he had been accused by Geregu Power Plc chairman, Femi Otedola, of taking possession of his shares in UBA.

Otedola revealed he helped finance the acquisition of UBA by Elumelu in 2005, but the latter double-crossed him when Otedola went bankrupt in 2008 by using the shares of the Geregu chairman to finance the loan he obtained from UBA.

“In 2005, while Tony was the Managing Director of Standard Trust Bank he approached me to get funds to acquire UBA. I enthusiastically gave him $ 20 million, which was N2 billion at that time to buy the necessary shares in UBA for the acquisition. After a short period of time, the share price moved up and I decided it was a good moment to sell and get out of the bank. However, Tony appealed to me to hold on to the shares as he was convinced that there were future prospects – so I kept the shares.

“I became Chairman of Transcorp Hotel in 2007 with a shareholding of 5% and unknowingly Tony gradually started buying shares quietly.

“By the following year in 2008, I went bankrupt in Nigeria. Tony proceeded to take my shares in UBA to service the interest on my loans and he also took over my shares in Africa Finance Corporation, where I was the largest shareholder,” Otedola said on Tuesday.

Note: The article was edited to correct errors in the value and volume of shares stated in the story.