President Bola Tinubu has been urged to end bank charges and reduce workers’ monthly contributions to pension schemes to cushion the negative effect of the fuel subsidy removal on Nigerians.

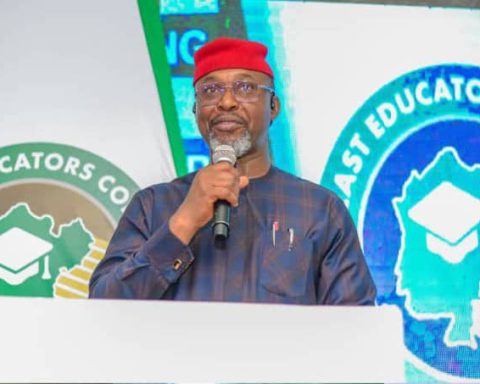

This was suggested by the former Minister of Aviation, Osita Chidoka, who questioned the immediate measures President Tinubu is implementing to ensure Nigerian workers are not cash-strapped because of his policies.

Join our WhatsApp Channel“We need to think beyond politics. When he (Tinubu) took a decision to remove subsidy and he removed fuel subsidy and the fuel prices rose by 100 and something naira to 500 and something naira in a day. What are the immediate measures that can be taken to make sure there is more cash in the pockets of people who go to work every day?” he asked during an interview with Channels TV on Sunday, 26 June 2023.

Chidoka also suggested the increase of minimum wage from the current N30,000, while also advising that the bank transfer charges should be stopped or reduced to one flat rate every month.

He said the banks are enriching themselves through bank charges so certain decisions need to be taken to ensure more money remains in the hands of Nigerians.

“If I was thinking with him, I would have said immediately: remove the charges for bank transfers in Nigeria, the N26 and the N56, cut it immediately. That money goes to the banks and they are just enriching themselves… or make a flat rate of once a month, you can charge N100 for IT (Information Technology) support. So, that puts more money in the hands of people.

“Second one is that our pension scheme has accumulated a lot of money and that pension scheme now requires people to pay 12% of their salaries from the employers’ side.

“So, I’m think you can reduce the amount the people are contributing for a one-year period or six months to allow more money.

“That way, immediately from the next month salary, another N10,000, N5,000 as the case may be, enters into the pocket of the people who goes to work every day. They are able to pay their transport fare because they need to go to work tomorrow. We can’t wait till when you take a decision (on ministerial appointments) to ameliorate the suffering,” Chidoka said.