President Bola Tinubu has faulted Godwin Emefiele-led Central Bank of Nigeria (CBN) for harshly implementing the Naira redesign policy.

Tinubu condemned the handling of the policy, stating that there are many unbanked Nigerians affected by the Naira redesign campaign initiated by Emefiele.

Join our WhatsApp ChannelPrime Business Africa recalled that Tinubu had criticised the policy during its implementation between February to March, stating that he was being targeted by the promoters of the policy.

The Naira redesign policy was also condemned by Nigerians and state governors, who filed a case against the Federal Government in the Supreme Court to force CBN to suspend the policy.

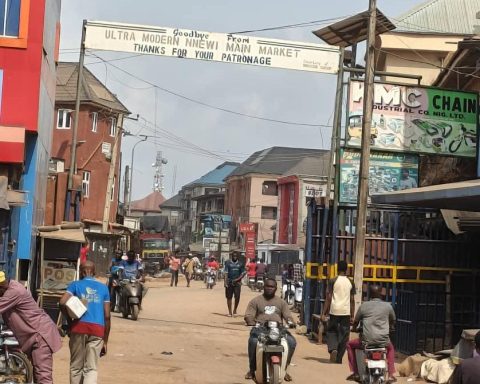

It had affected business transactions in Nigeria, as the CBN failed to print sufficient new banknotes to replace the old currencies it was mopping out of the economy.

This led to the scarcity of Naira notes, with some states in the Northern region forced to trade with Francophone currencies in order to survive.

The governors won the court case, with the Supreme Court order that the new and old Naira notes remain legal until December 31, 2023, thereby, voiding the CBN’s 10 February deadline to phase out the old banknotes.

Speaking on the Naira redesign policy on Monday, Tinubu said he will review the policy and in the meantime, both old and new N200, N500 and N1,000 notes will remain legal.

“Whatever merits it had in concept, the currency swap was too harshly applied by the CBN given the number of unbanked Nigerians.

“The policy shall be reviewed. In the meantime, my administration will treat both currencies as legal tender,” He said.

Tinubu also questioned the Monetary Policy Rate, known as the interest rate, which the CBN’s Monetary Policy Committee (MPC) increased to 18.5 per cent last week Wednesday, from 18 per cent, as the apex bank continued its aggressive push against the soaring inflation which stood at 22.22 per cent in April.

He said his administration will reduce the interest on loans, “Interest rates need to be reduced to increase investment and consumer purchasing in ways that sustain the economy at a higher level.”