President Muhammadu Buhari’s administration has suspended the removal of subsidy on fuel, leaving the decision to the President-elect, Bola Tinubu.

The Minister of Finance, Zainab Ahmed, previously stated that the subsidy will be removed in June, with the administration budgeting N3.35 trillion (47.5 billion) for subsidy payment from January to June 2023.

Join our WhatsApp ChannelHowever, two months before the removal, Vice-President, Yemi Osinbajo, approved the suspension at the National Economic Council (NEC) meeting which he presided over.

This was revealed on Thursday by Ahmed after the NEC meeting. She said the suspension was approved to allow the new administration to have a say in the decision.

She said during the transition of power from President Buhari to Tinubu, the removal of subsidy will be discussed, and if Tinubu feels the June date for the removal is feasible, the suspension will be lifted and the subsidy will be removed.

“What I said is that it is not going to be removed now, which means it will not be removed before the transition is completed. But then we have two laws that have inadvertently made the provision that we should exit by June.

“So, if the committee’s work, which will include the representatives of the incoming administration, determined that the removal can be done by June, than (sic) the work plan will be designed to exit as at June.

“But if the determination is that the period is extended it will mean that as a country, we will have to revisit the appropriation act for example, because the 2023 budget only [made] provision up to June.

“So, if we’re extending beyond June it means we have to revisit the appropriation act or amend the PIA. So, these are the reasons why we had to do this consultation, to get inputs from the government. They’re going to provide us their representatives to work together with us to have a defined process that will take us towards the removal.”

What you need to know

Ahmed said subsidy payment is not sustainable, and that when the time comes for removal, the removal will be done once and for all

The suspension means the government will have to draft another budget for subsidy, which means Nigeria could spend over $10 billion on fuel subsidy.

In 2022, the fuel subsidy gulped $9.7 billion (N4.39 trillion). Already, Buhari’s administration has budgeted more than half of last year’s budget for six months this year.

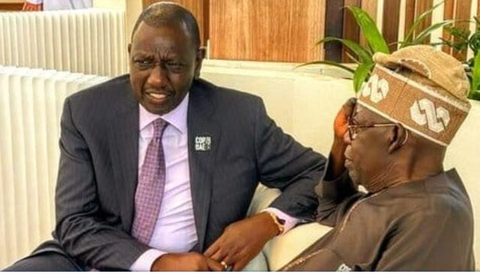

The decision to leave the fuel subsidy removal in Tinubu’s hands will result in the President-elect fulfilling or failing to fulfil one of his campaign promises – which is to also remove the subsidy – before his tenure begins.

This will be the first policy Tinubu will make during his tenure and his decision will signal two things;

Should Tinubu agree to remove the subsidy in June during the transition period in May, it will indicate he is willing to keep to his campaign promises – which will serve as defined government actions for the near future, allowing domestic and foreign investors to factor in his manifesto before making investment decisions.

However, should Tinubu also kick the can down the road like Jonathan and Buhari, as regards the subsidy removal, it will indicate he also intends to run an administration with economic policy uncertainty, which was the order of the day during Buhari’s administration. This discouraged foreign investments in Nigeria, leading to a decline in foreign capital importation, from $23.9 billion in 2019 to $5.32 billion in 2022.

The impact of fuel subsidy removal on Nigerians has often forced every administration to retain subsidy, as the labour union have often threatened to shut down the economy should the government remove it without working refineries.

Currently, Nigeria doesn’t refine its crude oil due to bad refineries. The country exports the commodity out of Nigeria and imports the refined product into Nigeria. In order to reduce the price of fuel, the government pays about $10 billion to control the fuel prices at filling stations.

The removal will raise the pump price from the current N189 per litre to about N400 according to oil marketers, but it will also result in competitive prices.

Tinubu had stated that regardless of protest, he will remove fuel subsidy. This will pit him against the Nigeria Labour Congress (NLC) and the Nigeria Union of Petroleum and Natural Gas Workers (NUPENG).

Without the refineries, the labour union and NUPENG are against fuel subsidy removal. It’s left to see if Tinubu would want to start his administration with nationwide protests that could shut down or impede the growth of the economy in his first year as President.