ByteDance, the powerhouse behind TikTok and Douyin, announced a move to repurchase up to $5 billion worth of shares from investors, drawing from its $50 billion cash reserve.

The company, renowned for its viral short-video apps, witnessed a revenue surge, amassing $29 billion in the three months ending June, marking a 40% increase from the previous year, sources revealed.

Join our WhatsApp ChannelIt was disclosed that ByteDance’s earnings before interest and tax reached $9 billion, reinforcing its robust financial standing.

By mid-year, the firm held $51 billion in cash, with a portion locked and unavailable for immediate use. However, its total debt amounted to $12 billion, insiders disclosed.

READ ALSO: Israel-Hamas Conflict: EU Tasks TikTok To Combat Disinformation

Backed by General Atlantic and SoftBank, ByteDance aims to repurchase shares at a valuation estimated around $260 billion, a notable drop from its $300 billion valuation during its previous employee-centric buyback last summer.

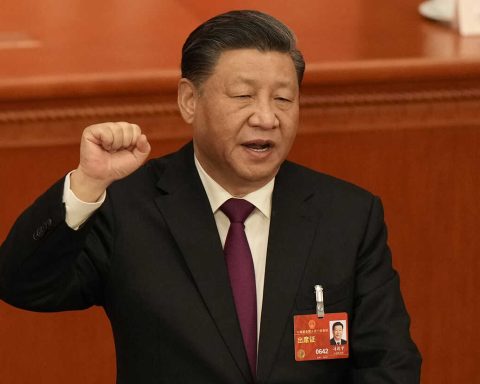

Founded in 2012 by Zhang Yiming, ByteDance rapidly ascended as one of China’s fastest-growing companies. Nevertheless, the company faced hurdles amid stringent regulatory measures from Beijing and heightened scrutiny from Washington, impeding its path toward a public offering.

ByteDance had over 3 billion monthly active users across its platforms, with TikTok and Douyin attracting 2 billion daily users in the second quarter.

Comparatively, Meta, the parent company of Facebook, Instagram, and WhatsApp, boasted just under 4 billion monthly active users, with 3 billion daily users on its platforms during the same period in a report by Financial Times

Despite its financial prowess and global user base, ByteDance has been tight-lipped about revenue and profitability figures, declining to comment. Speculations persist regarding its IPO prospects, overshadowing the company’s remarkable sales performance.

An investor in ByteDance expressed, “The numbers are staggering, but uncertainties loom until the Chinese government greenlights their potential public offering.”

ByteDance’s aggressive foray into e-commerce through Douyin poses a direct challenge to Alibaba in China, while investments to expand TikTok’s international e-commerce presence hint at the company’s ambition beyond its famed video-sharing platform.

The company’s fate remains entwined with regulatory decisions, creating an atmosphere of anticipation and caution within the industry.