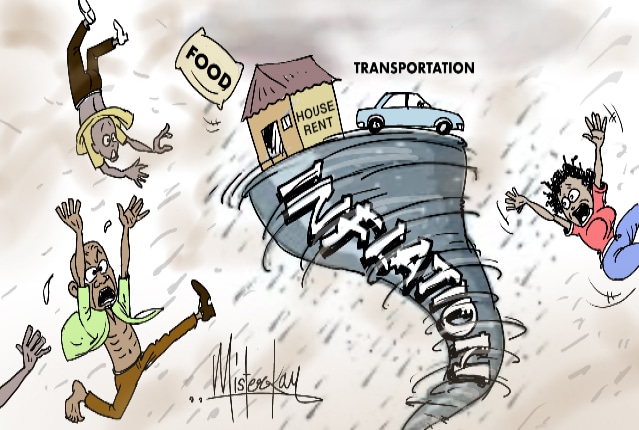

As Nigeria steps into 2025, the country is caught in an economic storm that has transformed how citizens perceive their dreams, hopes, and daily struggles. The soaring inflation rate—currently at 34.6%—has made survival a priority for millions. Once-ambitious plans to own homes, send children to better schools, or start businesses are giving way to the harsh reality of securing basic needs.

The removal of fuel subsidies in 2024 sparked the crisis, causing a domino effect of price hikes across all sectors. For many Nigerians, the aftermath feels less like a reform and more like a collapse. Public transport fares have tripled, and essentials like rice have become luxury items. A 50 kg bag of rice now costs N75,000, an expense far beyond the reach of most households. Meanwhile, the naira’s 70% devaluation has worsened import costs, further tightening the economic noose.

Join our WhatsApp ChannelPresident Tinubu’s New Year speech projected optimism, with promises to slash inflation to 15% by the end of 2025. Yet, the lack of effective social safety nets leaves citizens questioning whether these goals are achievable.

Nigerians Speak: Voices From the Streets

In Lagos, the nation’s economic hub, the inflation crisis hits differently across its sprawling districts. Speaking to young Nigerians reveals the stark reality of their struggles.

“I’ve stopped taking buses to work,” says Temidayo, a 28-year-old bank worker in Ikeja. “I now walk two hours daily because transport costs eat into my budget for food. I used to think life was tough before, but now it feels impossible.”

At the Deeper Life Conference Centre, Tobi, a 31-year-old freelance graphic designer, explains how inflation has eroded his business profits. “The cost of materials for printing has tripled. Clients don’t want to pay extra, but I can’t keep running at a loss.”

Even middle-class residents are not spared. Grace Ademi, a 27-year-old teacher in Surulere, shares her ordeal. “My salary was adjusted to the new minimum wage of N70,000, but rent and food prices have gone up so much that it feels like I earn less than before. I hardly have funds to invest in other things. We are just merely surviving”

In Ajegunle, Debo Leke, 24, who runs a PoS shop, laments the loss of customers. “People are ffinding it difficult to withdraw due to increase in the price. But it not our fault. Things have seriously gone up. The inflation is killing us, and we do not even know when it will end.”

READ ALSO: New Year Message: Tinubu Restates Commitment To Reducing Inflation To 15% In 2025 (Full Text)

Meanwhile, Uche Emeka, a tech support officer who lives in Lekki, reflects on the mental toll. “Everyone’s stressed. You see it in the way people talk to each other on the streets or in offices. It’s like we’re all trying to survive day to day.”

Expert Insights: What Lies Ahead?

Economists and social analysts weigh in on the complex factors fueling Nigeria’s inflation crisis.

Dr. Akin Alade, an economist at Lagos Business School, criticises the government’s approach. “Removing fuel subsidies was necessary, but it should have been done with proper safety nets. Targeted subsidies or conditional cash transfers could have softened the blow on the most vulnerable.”

Social commentator Bola Akintoye adds, “The problem isn’t just inflation; it’s the structural flaws in our economy. We import too much and produce too little. Until the government focuses on boosting local production and securing our agricultural sector, we’re stuck in this vicious cycle.”

Rising Costs, Falling Dreams

The impact of inflation is not just financial—it’s psychological. Dreams that once seemed attainable now feel distant. Many young Nigerians say they have postponed or abandoned long-term goals.

“I wanted to start my own business this year,” Tobi shares. “Now I’m just focused on not falling deeper into debt.”

For Uche, the idea of owning property seems almost laughable. “I used to save for land in my village, but now I can’t even save enough to restock my shop properly.”

Grace expresses similar sentiments about family planning. “I wanted to have kids in a few years, but raising a child in this economy feels like an impossible task.”

Policy Gaps and Missed Opportunities

Critics argue that while President Tinubu’s goals for 2025 are commendable, their execution remains uncertain. The promise to reduce inflation to 15% will require more than optimistic speeches.

Dr. Alade emphasises, “Without stabilising the naira and reducing reliance on imports, cutting inflation to 15% in a year is more fantasy than strategy.”

Ms. Akintoye concurs, highlighting the need for transparency. “The government must show the public how they plan to achieve these targets. Grand promises without action only deepen public distrust.”

The Way Forward

Experts agree that reversing the inflation crisis will demand targeted interventions. These include investments in agricultural infrastructure, fostering local manufacturing, and providing direct financial support to the most vulnerable.

“Food security is key,” says Dr. Alade. “We need to boost local production, not just talk about it. This will reduce reliance on imports and stabilise food prices.”

Ms. Akintoye stresses the importance of collaboration. “The government must engage stakeholders, from small traders to large manufacturers, to craft realistic policies. The current top-down approach isn’t working.”

Survival as the New Nigerian Dream

As 2025 unfolds, one thing is clear: the average Nigerian’s dream has shifted. Survival now outweighs aspiration. Whether it’s walking to work, cutting meals, or delaying life goals, citizens are doing whatever it takes to stay afloat.

Temidayo sums it up poignantly. “We’ve gone from dreaming big to just hoping to make it through the month. That’s the new Nigerian reality.”

For millions, the hope lies not in political promises but in their own resilience. Yet, without urgent, effective government action, even that resilience may not be enough.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

Follow Us