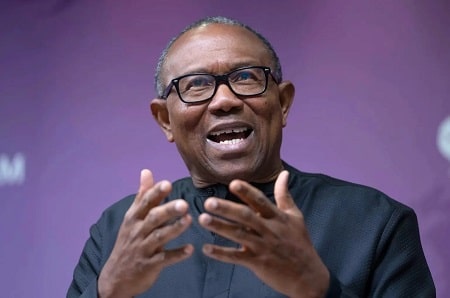

Former Governor Calls for Public Engagement

The former governor of Anambra State, Peter Obi, has urged the Federal Government to secure Nigerians’ agreement before implementing policies embedded in the tax reform bills under consideration in the National Assembly. Speaking on Monday, Obi emphasised that while tax reforms are critical, any changes must involve broad public participation and transparency.

Obi remarked, “Public hearings are essential to gather opinions from across the country. Inclusivity strengthens trust, which is the foundation of effective governance.”

Join our WhatsApp ChannelCalls for Public Hearings

In his statement, Obi stressed the importance of creating avenues for public discourse to ensure that citizens feel involved in decisions that impact their lives. He argued that reforms of this magnitude should not be rushed but subjected to informed discussions.

“Matters of this magnitude require extensive deliberation and careful consideration,” he said, adding that public hearings would enable diverse views to shape the policy. Obi emphasised that the government must prioritise public awareness and build trust before implementing significant changes.

READ ALSO: How Tax Reform Bills Stir Controversies, Further Divide Citizens

Impact Beyond Revenue

Highlighting the broader implications of the tax reform bills, Obi pointed out that it is not enough to focus on increasing government revenue. “Stakeholders must consider how these bills will affect every region and the sustainability of the nation as a whole if passed into law,” he said.

The proposed reforms aim to adopt a derivation principle in VAT revenue allocation, which has drawn criticism from various quarters. Obi noted that transparency and deliberation must guide the government’s approach to ensure equitable outcomes.

Northern Stakeholders’ Concerns

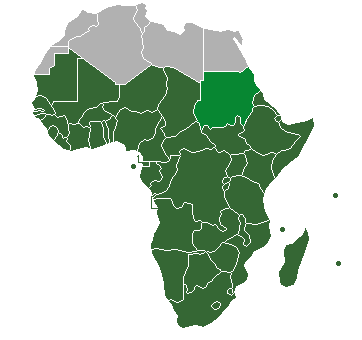

The tax reform bills have sparked significant debate, particularly among northern elites who argue that the proposed changes may not favour their region. Under current laws, VAT revenues are distributed among federal, state, and local governments based on specific formulas, including population and equality metrics.

The new proposals suggest allocating VAT revenues based on derivation, a principle that allocates funds based on the revenue generated by each region. Northern stakeholders have expressed concerns that such a model may disadvantage less economically active areas.

A Participatory Approach

Peter Obi’s statements align with calls from other political figures, including former Vice President Atiku Abubakar. Abubakar emphasised the need for public hearings that allow for participation by civil society groups, traditional leaders, and subject matter experts.

“These reforms require open and inclusive processes,” Abubakar noted, suggesting that the bills should not prioritise revenue generation over regional sustainability and public welfare.

What Lies Ahead for Tax Reform Bills

The tax reform bills, currently under review in the National Assembly, propose adjustments that could reshape Nigeria’s fiscal landscape. Public opinion is expected to play a critical role in determining their fate, as calls for inclusivity and transparency grow louder.

Obi concluded by urging the government to ensure that the reforms reflect the will and best interests of Nigerians, stating, “Trust and legitimacy are paramount. Without them, even well-intentioned reforms risk failure.”

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.