In continuation of our last article on the CBN’s Nigeria Inter-bank Settlement System (NIBSS), we previously brought you ideas on how NIBSS has powered digital payments to new heights through its Instant Payment System (IPS). With support from AFRICANENDA, together with the World Bank and the European Economic Commission for Africa, NIBSS has demonstrated the inclusiveness, and accessibility of IPS to end users and operators.

As we have observed in part 1 of this series, the SIIPS study is consumer research involving “extensive in-country qualitative and quantitative research covering low-income adult individuals and micro, small, and medium-sized enterprises (MSMEs) across seven countries: The Democratic Republic of Congo, Egypt, Ghana, Kenya, Nigeria, Tanzania, and Zambia”.

Join our WhatsApp ChannelREAD ALSO: Talk To CBN Through Your Bank: What Do You Feel About Nigeria’s Online Payment Systems?

The qualitative techniques of in-depth interviews, focus group discussion and immersions to understand the “key drivers of shifting consumer behavior toward IIPS”. In this offering, we present a digest of SIIPS research results on consumer behaviour, perceptions, drivers and barriers to digital payments.

Qualitative study Outcomes

Through the qualitative techniques, the SIIPS 2022 report showed that “personal preference, the nature of transactions, and merchants’ acceptance of digital payments are among the key determinants of how payments are made.” Many buyers would prefer to use digital payment options, but are often forced to make other decisions based on prevailing circumstances such as whether a vendor has a digital account or the quantity of products purchased. Summarily, “key considerations for cash or mobile money usage include perceived speed and convenience, incentives, and better planning and management of finances”. This means that buyers and vendors alike are taking advantage of perceived benefits in the digital options such as simplicity of use, rewards from digital money providers, and the tendency to be more prudent in spending on the digital platform.

READ ALSO: Naira Hits N1,532/$1 As Nigerians Lament Worsening Economic Crisis

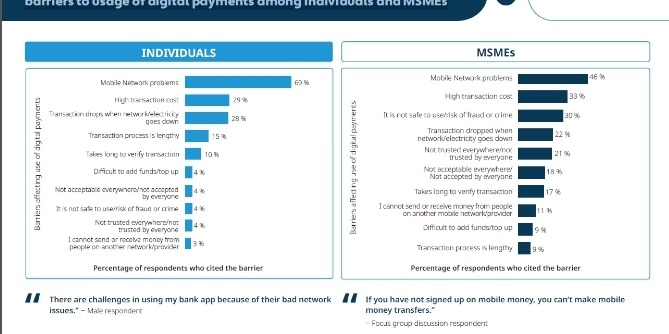

Against the backdrop of these benefits, the SIIPS 2022 report also showed that consumers complained that “poor network connectivity and high transaction costs are the leading barriers to usage of digital payments among individuals and MSMEs” as shown in Figure 1.

Figure 1: Barriers to digital payments

Solving the problems

Rising transaction charges, network connection problems, delayed transaction alerts and fear of fraud or scam are the most potent among customers. However, traceability of transactions, openness through the display of transfer beneficiary names and the use of passwords have increasingly offset most of these barriers. And as the barriers give way, the report concludes as follows:

- Cash is still widely used among individuals, though its use is declining among MSMEs. Small enterprise owners, especially, opt for using bank customer apps.

- Comparatively, Nigeria has a high level of trust and acceptance of digital payment through banking apps.

- The banking sector in Nigeria has been instrumental in growing the breadth and depth of digital payments through the different innovative solutions available in the market.

- Bank cards are a key digital payment channel used in Nigeria.

- Mobile money is not prevalent, though it is growing in use and acceptance.

READ ALSO: Instant And Inclusive Payments Systems: From Fear To Fast Payouts

Some recommendations from user experiences

The report recommends increased effort at addressing customer concerns following user experiences, which should align with service offerings. The most important concerns arise because “customers feel that they pay double transaction charges for the same services from the same providers. For example, bank maintenance fees, bank transfer charges, bank mobile charges per transaction are all surcharged to the same account holder”. Access to customer care and representatives should be addressed digitally to sidestep delays.

In concluding the recommendations, the report reaffirms the call of the present article by asking “In your opinion, what should be done to make digital payments more instant and inclusive?” Just talk to your bank.

Dr Mbamalu, a Jefferson Fellow, is an Editor, Publisher and Communications Consultant. Follow on X: @marcelmbamalu

Dr. Marcel Mbamalu is a communication scholar, journalist and entrepreneur. He holds a Ph.D in Mass Communication from the University of Nigeria, Nsukka and is the Chief Executive Officer Newstide Publications, the publishers of Prime Business Africa.

A seasoned journalist, he horned his journalism skills at The Guardian Newspaper, rising to the position of News Editor at the flagship of the Nigerian press. He has garnered multidisciplinary experience in marketing communication, public relations and media research, helping clients to deliver bespoke campaigns within Nigeria and across Africa.

He has built an expansive network in the media and has served as a media trainer for World Health Organisation (WHO) at various times in Northeast Nigeria. He has attended numerous media trainings, including the Bloomberg Financial Journalism Training and Reuters/AfDB training on Effective Coverage of Infrastructural Development of Africa.

A versatile media expert, he won the Jefferson Fellowship in 2023 as the sole Africa representative on the program. Dr Mbamalu was part of a global media team that covered the 2020 United State’s Presidential election. As Africa's sole representative in the 2023 Jefferson Fellowships, Dr Mbamalu was selected to tour the United States and Asia (Japan and Hong Kong) as part of a 12-man global team of journalists on a travel grant to report on inclusion, income gaps and migration issues between the US and Asia.

Follow Us