With Nigeria’s cashless policy gathering pace since the 2022-2023 naira redesign misadventure, the CBN has doubled down on its efforts to oil the engines of electronic payments. CBN’s Nigeria Inter-bank Settlement System (NIBSS) has powered the Instant Payment System (IPS) to new heights.

Every year since 2021, the CBN, through NIBSS, releases research results on the state of instant and inclusive payment systems (SIIPS). The research data comes from industry analysis, which “explores key trends, best practices, and benchmarks, to inform the development and scaling of instant and inclusive payment systems to accelerate financial inclusion in Africa.”

Join our WhatsApp ChannelSIIPS is presented by NENDAFRICA, together with the World Bank and the European Economic Commission for Africa. You can offer your views to your bank since the IPS, according to AfricaNenda, is based on “only systems with live transactions and functionality”, using data from publicly available resources gathered through extensive stakeholder interviews.

READ ALSO: Instant And Inclusive Payments Systems: From Fear To Fast Payouts

In the 2022 report, SIIPS inspired hope about the IPS ecosystem in Africa, by highlighting its inclusiveness, accessibility and improved operational opportunities for banks and other licensed payment providers. The report offers opportunities to end users and operators to vent their views, advice and experiences towards enriching the IPS in its march to meet the needs of all stakeholders.

SIIPS Study Technique

The SIIPS study is consumer research involving “extensive in-country qualitative and quantitative research covering low-income adult individuals and micro, small, and medium-sized enterprises (MSMEs) across seven countries: The Democratic Republic of Congo, Egypt, Ghana, Kenya, Nigeria, Tanzania, and Zambia”. The research results are communicated in the annual SIIPS report. In its early stages, the SIIPS study hopes to use more nationally representative samples “to draw out insights to inform how IPS can be designed to better meet the needs of end-users”.

You can talk to your bank without fear, and in the language you know such as USSD (mobile money wallet), all payment/banking applications, mobile money agents, credit/debit cards/POS, and cash lodgments.

Why your views matter

In talking about the above issues, you will help the CBN and NIIBS to “understand which payment methods are used and for which purposes”, as well as to “identify motivators and barriers consumers face when using digital payments”. Your views will better “define the challenges experienced in accessing digital payments and opportunities for adoption”. What is more? Your views will help the CBN to “explore use cases, desired features, and unmet needs and expectations of digital payments”.

See figure 1 to know that you are one of those who can offer their thoughts about IPS.

Figure 1: Who can be used in the study?

Source: AfricaNenda, 2022

Insights from the 2022 report

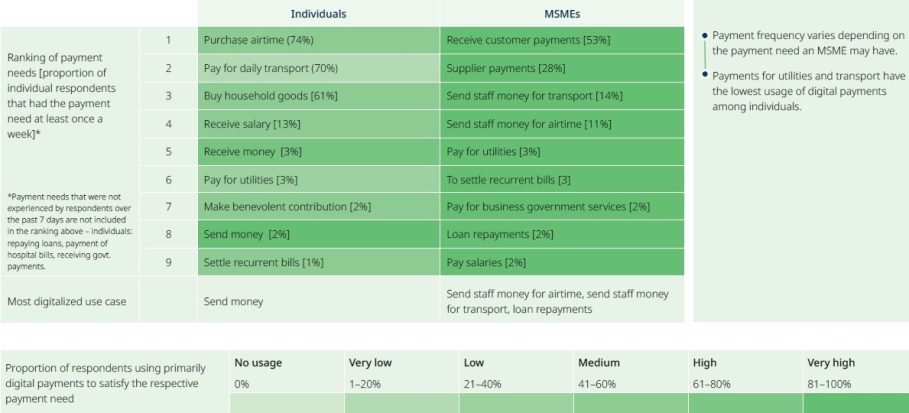

NIIBS conducted its 2022 study through field surveys involving quantitative research which aimed to “identify trends in customer behavior”. It also adopted qualitative techniques of in-depth interviews, focus group discussion and immersions to understand the “key drivers of shifting consumer behavior toward IIPS”. In its assessment of payment instruments, it addressed user needs, usage patterns and general consumer payment behaviour as shown in figure 2.

Figure 2: Uptake of payment of digital payments

Source: SIIPS, 2002 by AfricaNenda

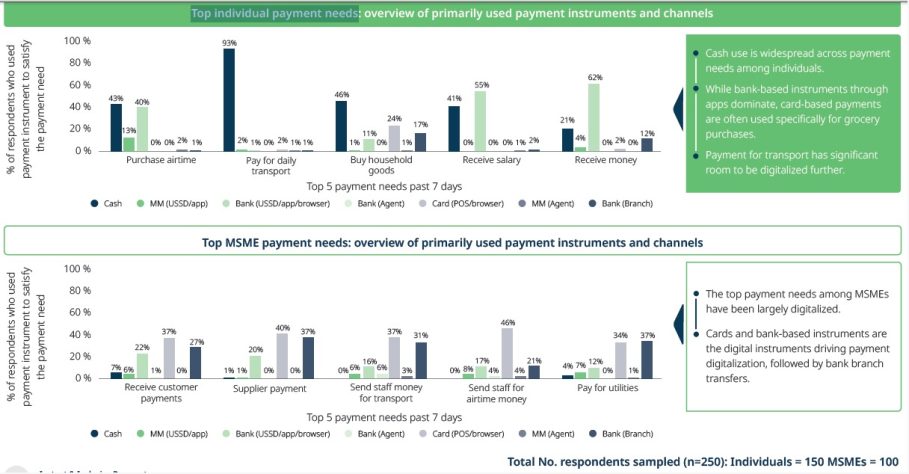

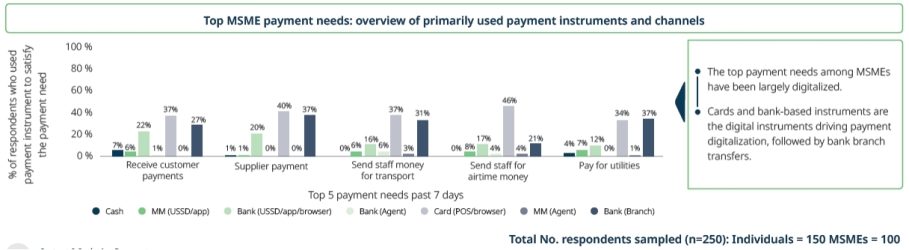

The figure shows that MSMEs demonstrated strong uptake of digital payments for most of the leading payment needs. It further breaks down the top individual payment needs in Figures 3 and 4.

Figure 3: Top individual payment needs

Source: SIIPS, 2002

Figure 4: Top MSME payment needs

Source: SIIPS, 2022

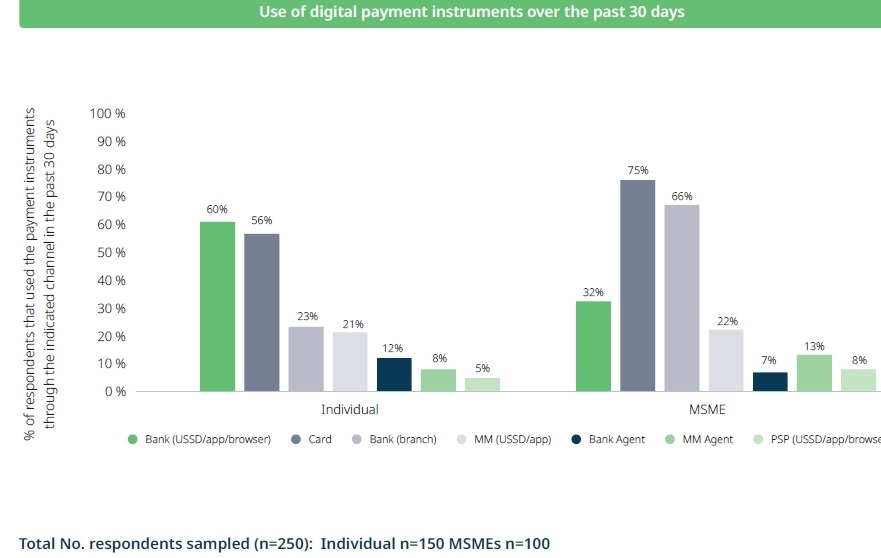

The SIIPS report further showed that bank-based payment channels are leading in use by both individuals and MSMEs (Figure 5). MSMEs have higher usage of card-based payments than individuals. MSMEs have a higher preference for using bank branches as a channel over USDD or apps. Though a relatively new addition to the payments landscape, mobile money payments have grown and are conducted by one-fifth of individuals and MSMEs.

Figure 5: Use of digital payments instruments over a 30-day period

Our next series will digest SIIPS research results on consumer behaviour, perceptions, drivers and barriers to digital payments.

Dr Mbamalu, a Jefferson Fellow, is an Editor, Publisher and Communications Consultant. Follow on X: @marcelmbamalu

Dr. Marcel Mbamalu is a distinguished communication scholar, journalist, and entrepreneur with three decades of experience in the media industry. He holds a Ph.D. in Mass Communication from the University of Nigeria, Nsukka, and serves as the publisher of Prime Business Africa, a renowned multimedia news platform catering to Nigeria and Africa's socio-economic needs.

Dr. Mbamalu's journalism career spans over two decades, during which he honed his skills at The Guardian Newspaper, rising to the position of senior editor. Notably, between 2018 and 2023, he collaborated with the World Health Organization (WHO) in Northeast Nigeria, training senior journalists on conflict reporting and health journalism.

Dr. Mbamalu's expertise has earned him international recognition. He was the sole African representative at the 2023 Jefferson Fellowship program, participating in a study tour of the United States and Asia (Japan and Hong Kong) on inclusion, income gaps, and migration issues.

In 2020, he was part of a global media team that covered the United States presidential election.

Dr. Mbamalu has attended prestigious media trainings, including the Bloomberg Financial Journalism Training and the Reuters/AfDB Training on "Effective Coverage of Infrastructural Development in Africa."

As a columnist for The Punch Newspaper, with insightful articles published in other prominent Nigerian dailies, including ThisDay, Leadership, The Sun, and The Guardian, Dr. Mbamalu regularly provides in-depth analysis on socio-political and economic issues.