To sustainably tackle inflationary pressures on the economy, Lagos Chamber of Commerce and Industry (LCCI) has urged the Central Bank of Nigeria (CBN) to extend its targeted intervention schemes to productive sectors in order to reduce cost of production.

According to the Chamber, a combination of factors such as high cost of petroleum products, electricity tariff hikes, insecurity, and the illiquidity crisis in the foreign exchange market affect cost of production which consequently cause prices of things to rise continuously.

LCCI gave the recommendation in a statement issued on Friday, 27th May, while reacting to CBN’s recent Monetary Policy Rate (MPR) increase.

Join our WhatsApp ChannelAt the Monetary Policy Committee (MPC) meeting of the CBN which held on Tuesday, 24th May, the apex bank raised the MPR from 11.5 per cent to 13 per cent in response to the current challenges in the country’s economy and rising inflation rates across many economies globally.

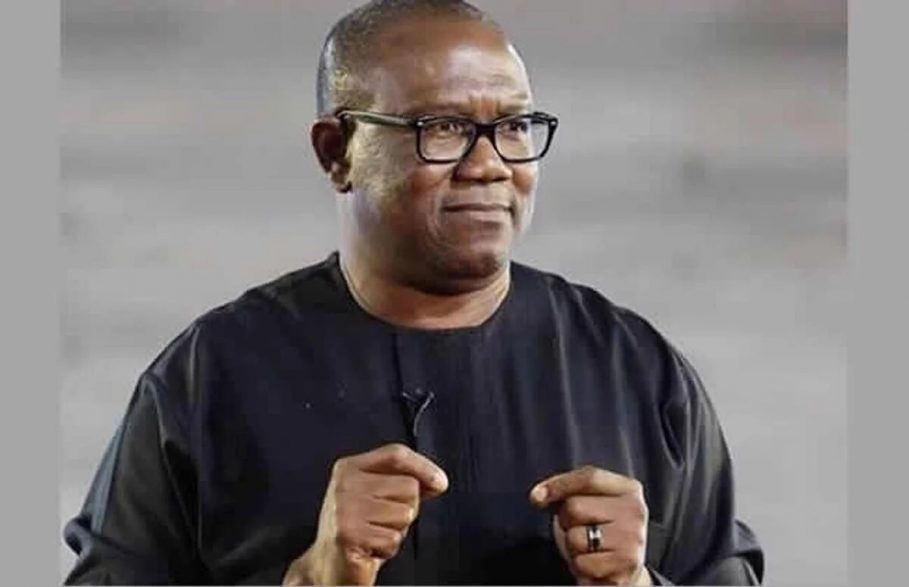

Director-General, LCCI, Dr. Chinyere Almona, said the MPR hike was expected by the chamber given the current economic trend, as a way of controlling “the rising inflation rate feared to assume a galloping trend soon.”

She maintained that those factors that have continued to affect the cost of production thereby pushing up prices of things (cost-push Inflation) needed to be tackled head-on for the inflationary pressure on the economy to drop.

The chamber explained that hike in the interest rates will obviously lead to less credit to the private sector which can translate to reduced investment and constrain production in the economy, at least in the short term.

Such development, it further stated, has has implications for economic growth, job creation, and revenue generation for the government. “When the MPR was 11.5% some credit lenders charged as high as 25% maximum rate to small companies. With the benchmark interest rate at 13%, we may likely have rates climb beyond 30% for SMEs,” the chamber stated.

“While we agree with the proposition that a lower interest rate in Nigeria compared with higher rates in developed economies would lead to capital flight, we must restate our recommendation that interest rate hikes will not on their own curb inflationary pressures.

“The supply-side challenges like insecurity, forex scarcity, and uncertainties from the inconsistent policy environment must be tackled to curb the rising inflation. This is the more sustainable solution to the rising inflation in Nigeria,” it added.

LCCI pointed out that hike in interest rate alone will not address the inflation trend in Nigeria which is near galloping level and advised that interventions are needed “to boost the supply of goods and services, build critical supportive infrastructure, and resolve the illiquidity crisis in the forex market.”

It further noted that beyond the role of price stability, the CBN must pay attention to sustaining economic growth that can create jobs and boost government revenues.