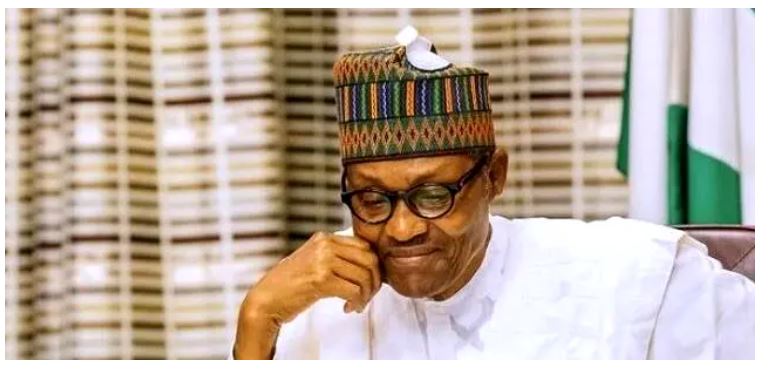

The Debt Management Office (DMO) has advised President Muhammadu Buhari’s administration to focus on increasing revenue rather than piling up debt that has risen to N42.84 trillion ($103.31 billion) at the end of Q2, 2022.

Director-general of Nigeria’s Debt Office, Patience Oniha, said government’s priority should be improving revenue from oil and non-oil sources.

Join our WhatsApp ChannelOniha explained to the Nigerian legislature on Thursday that borrowing at this juncture of our national history would attract high interest rates as international and domestic debt markets have become tighter on liquidity.

She made the statement during a workshop for members of the Senate Committee on local and foreign debts and the House of Representatives Committee on Aid, Loans, and Debt Management.

The DMO boss said there’s the need for the Federal Government to ‘rationalise’ expenditure and ramp up revenues. According to her, disbursing the borrowed funds into revenue-based projects will provide the much needed capital to service existing loans.

Speaking at the workshop, Oniha said, “priority should be less on borrowing and more on revenue from oil and non-oil sources.”

She also told the lawmakers that, “Nigeria’s public debt stock has grown consistently over the past decades and even faster in recent years, the same manner debt servicing has continued to grow.

“Nigeria’s low revenue base, compounded by dependence on crude oil, resulted in deficits over the past decades,” Oniha explained.

Meanwhile, the DMO boss updated the Legislature on the level of Chinese debt held by the Nigerian government. Oniha said Nigeria owes China $3.6 billion, representing 3.6 percent of the country’s external debt.

Oniha, however, stated that, regardless of the burden of Chinese debt on Nigeria, ”the good thing is that Chinese loans are concessional. It is not our dominant source of funding,” she said, adding, “It is actually small but it finances infrastructure, which is a good thing.”

The DG revealed that domestic debt accounts for N26.2 trillion of Nigeria’s total debt stock, with external debt stocks accounting for N16.6 trillion. With the total debt standing at N42.84 trillion, she said the debt level is not alarming.

Oniha explained that Nigeria has a self-imposed 40 percent limit for debt to Gross Domestic Product (GDP) ratio, but the current debt to GDP ratio is 23.06 percent, which is also below “the World Bank/IMF recommended limit of 55 percent for countries within Nigeria’s peer group and 70 percent for ECOWAS countries.”

Follow Us