The N6 trillion tax and import duties waivers for companies proposed by President Muhammadu Buhari in the 2023 budget has been turned down by the Senate committee on finance.

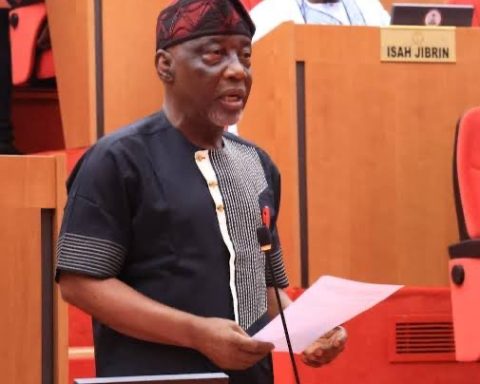

In a bid to reduce the N12.43 trillion budget deficit, the committee, led by Solomon Adeola, said on Tuesday, that the tax waiver should be stepped down to N3 trillion, as some companies are taking advantage of the initiative.

Join our WhatsApp ChannelAdeola made this known during the panel meeting to review the proposed 2023-2025 medium-term expenditure framework and fiscal strategy paper (MTEF/FSP) with Minister of Finance, Zainab Ahmed.

“The proposed N12.43 trillion deficit for the 2023 budget and N6 trillion waivers are very disturbing, and must be critically reviewed.” The lawmaker said, adding, “Many of the beneficiaries of the waivers are not ploughing accrued gains made into expected projects as far as infrastructural developments are concerned.”

“The same goes for tax credit window offered by the FIRS to some companies.” Adeola said, explaining that, “Billions and trillions of naira can be generated by the government as revenue if such windows are closed against beneficiaries abusing them and invariably provide required money for budget funding with less deficit and borrowings.

“The NCS should help in this direction by critically reviewing waivers being granted on import duties for some importers just as the FIRS should also review the tax credit window offered some companies without corresponding corporate social services to Nigerians in terms of expected project executions like road construction.

“We cannot accommodate this N6 trillion tax waivers. It is in this way that the committee frowns at the projected N12.41 trillion budget deficit contained in the 2023-2025 MTEF/FSP and the alarming projection of ‘no provision for treasury-funded MDAs’ capital projects in 2023.

“This scenario is unacceptable, and we must find ways to drastically reduce the deficit.” Adeola told Ahmed.

He said the government must free funds by blocking all revenue leakages and misuse in ministries, departments and agencies (MDAs). Adeola also stated that government expenditure needs to be controlled as well, hence, the need to scrutinise finances in the budget.

“It is apparent that the borrowing trends cannot be allowed to continue unchecked and conscious efforts must be made to reduce budget deficits.

“Achieving these goals requires us to look inwards towards increased revenue generation, blocking of leakages and restraints on what are generally frivolous expenditures by MDAs, particularly the Government Owned Enterprises (GEOs).

“Our preliminary findings and directives to some of the agencies had led to the payment of millions of naira into CRF in accordance with the fiscal responsibility Act 2007 and the 1999 Constitution.

“It is needless to say that these millions not paid to CRF contribute to the yearly huge budget deficits of the federal government.

“The investigation was also able to get some agencies to accept opting out of the federal budget altogether based on their internal revenue generating ability. Some of these findings are relevant to the proceedings of this 5-day interactive session.

“From the challenges thrown up against our economy in terms of the Russia-Ukraine war, the impact of crude oil theft, insecurity, and continuing infrastructure deficits, it is time for all to agree that it cannot be business as usual for government revenue and expenditures.

“We need to block all revenue leakages and misuse in ministries, departments and agencies (MDAs) as well as control expenditure to free funds for needed infrastructure development and provision of social services.” Adeola said.