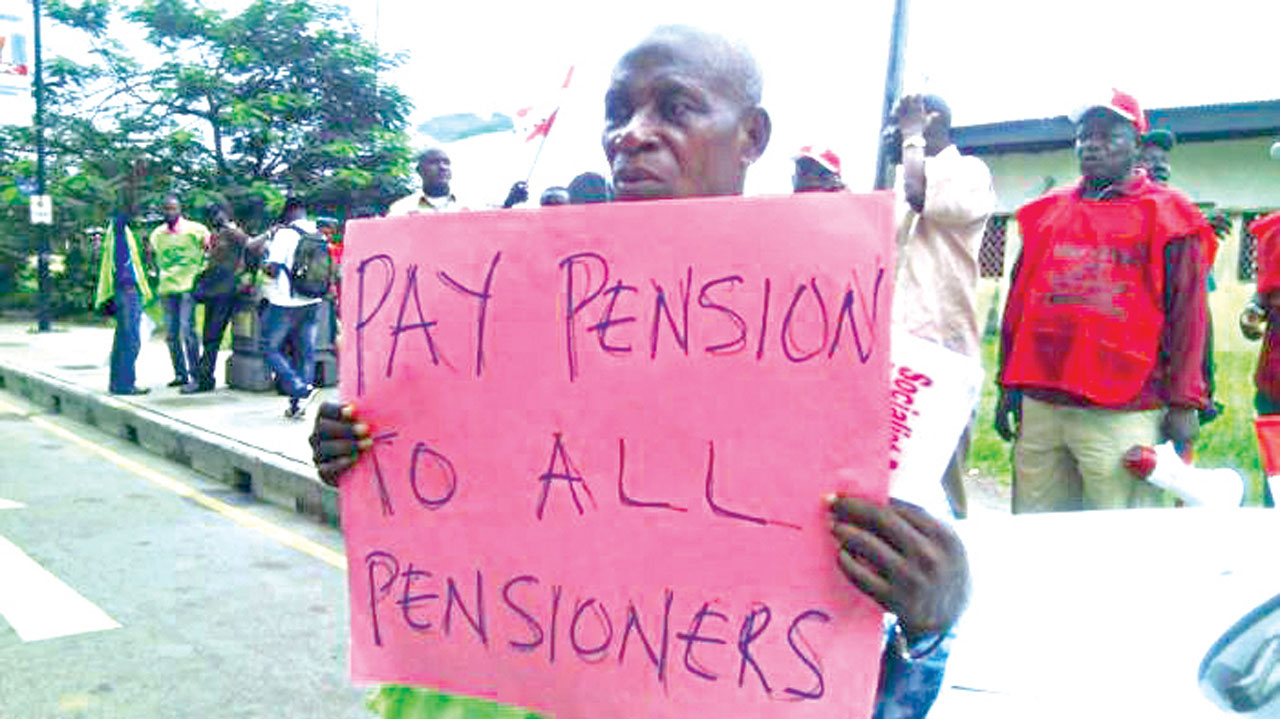

Retirees enrolled in Nigeria’s Contributory Pension Scheme (CPS) have intensified their call for equitable treatment, demanding the implementation of minimum pensions and addressing long-standing grievances.

The Contributory Pensioners Union of Nigeria, represented by its President, Matthew Shittu, emphasized these concerns in a recent statement titled ‘Demand for the full implementation of Contributory Pension Scheme in Nigeria.’

Join our WhatsApp ChannelExpressing disappointment over the omission of pensioners from the recent federal civil service wage increase, the retirees highlighted the need for provisions catering to those under the CPS.

“We demand a provision to be made for this group of contributory pensioners,” stated the retirees in their plea directed at key figures including President Bola Tinubu, the Chief of Staff of the Federation, the Senate president, and the director-general of the National Pension Commission.

READ ALSO: Pension Assets Surge To N17.66tn; Worker Contributions Drive Substantial Growth

Acknowledging the Federal Government’s prompt fund releases, the union urged the timely disbursement of pensions to CPS retirees. They further pressed for the immediate implementation of pending pension increments based on the percentages calculated from 2007 and 2010, which are yet to be paid.

Moreover, the retirees expressed dissatisfaction over the lack of transparency regarding the formula used to calculate pension benefits under the CPS. They highlighted outstanding dues dating back to the scheme’s inception in 2004, specifically mentioning accrued interest owed to members.

“We demand the calculation of all accrued interests as of July 2004 at the government’s official interest rate,” emphasized the union, underscoring the need to compensate members for these financial discrepancies.

Additionally, the union demanded representation in the upcoming 2024 Pension Act Review Committee, emphasizing their preference for stakeholders to champion their cause.

Rejecting the practice of delayed entitlement payments spread over several years, the retirees urged direct disbursement of delayed entitlements to beneficiaries without any further delay.

“The union seeks fair treatment and representation, not just lip service,” stressed the union, emphasizing the need for tangible action to rectify these long-standing issues affecting retirees under the CPS.