Governor Dapo Abiodun of Ogun State has emphasised that the resistance to Nigeria’s proposed tax reform bills is largely a result of misinformation and misinterpretation. Speaking at the Africa Investment Forum in Rabat, Morocco, on Thursday, the governor argued that better communication of the reform’s purpose would foster greater acceptance.

“The misconception is that some of our people did not take time to interrogate and understand the reform. There was also a lot of suspicion around the intention,” Abiodun explained.

Join our WhatsApp ChannelHe stressed that the tax reform bills, spearheaded by the Federal Government, are designed to improve the financial standing of states across the country.

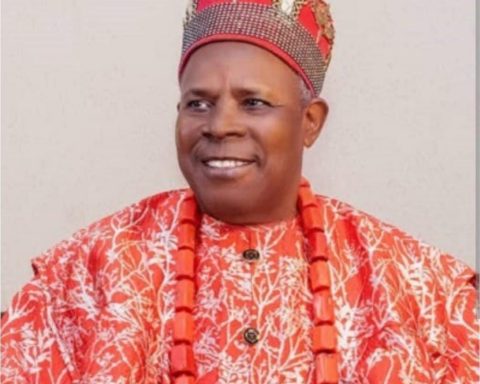

Governor Abiodun Supports the Tax Reform Bills

Governor Abiodun stated his strong belief in the benefits of the tax reform bills, noting their potential to positively transform subnational economies.

“We, in Ogun State, and I, as a responsible member of the Governors’ Forum as well as a patriotic Nigerian, are convinced that the purpose of the reform is in the best interest of every subnational government in Nigeria. This I say without a shadow of a doubt,” he asserted.

The governor highlighted ongoing efforts by the Governors’ Forum to ensure clearer communication about the reforms. He acknowledged the need for more engagement with stakeholders to dispel misunderstandings.

“I’m sure that by next week or so, you will more than likely see a better understanding from all stakeholders – that it is not what they thought it was. There are more benefits,” Abiodun said.

Tax Reform Bills and Value Distribution

Abiodun also pointed out that the proposed tax reform bills aim to address inequities in value-added tax (VAT) distribution. According to him, the current VAT system disadvantages Ogun State despite its significant contributions to Nigeria’s industrial output.

READ ALSO: Tax Reform Bills: How Good Policy Can Turn Sour

“The current situation puts us at a great disadvantage in Ogun because we’re the industrial capital of Nigeria, number one in non-oil revenue in Nigeria, and we have an abundance of almost every natural resource,” the governor explained.

He noted that under the present framework, many companies based in Ogun State remit their VAT to other states where their head offices are located.

“With this reform, we feel that VAT should be attributed to where values are added the most. For example, if a bag of cement is produced in Ogun State and sold elsewhere, where is the most value-added? Is it at the point of sale, or is it where it’s actually mined, packed, bagged, and transported?”

Misinterpretation of Tax Reform Bills

Governor Abiodun addressed concerns raised by critics of the tax reform bills, reiterating that the reforms were designed to benefit all stakeholders.

“There was gross misinformation and misinterpretation about the tax reform bills. The purpose is to make taxation consumption-oriented and ensure fairness,” he said.

The governor revealed that discussions among state governors and federal agencies were helping to refine the proposals for more equitable implementation.

Moving Forward with the Tax Reform Bills

The governor expressed optimism that as conversations continue, skepticism about the tax reform bills would diminish.

“At the Governors’ Forum level, there has been painstaking engagement going on, and soon, the cloud will clear as everyone embraces reality,” he stated.

Governor Abiodun encouraged Nigerians to critically evaluate the reform rather than rely on hearsay. He expressed confidence that the proposed changes would create a fairer and more effective tax system.

“It is in our collective interest to ensure that this reform works because, at the end of the day, it benefits every Nigerian state,” he concluded.