Former vice president, Atiku Abubakar, has criticised the proposed increase of the value-added tax (VAT) by the Tinubu-led administration from 7.5 per cent to 10 per cent.

Prime Business Africa reports that the Presidential Committee on Fiscal Policy and Tax Reforms recommended an increase in VAT to 10 per cent and a further rise to 15 per cent by 2027 or 2030.

Join our WhatsApp ChannelHowever, in a post via his X handle on Sunday, Atiku described the proposed increase of VAT as a “regressive and punitive policy”, adding that together with the hike in the price of petrol by the Nigeria National Petroleum Company (NNPCL), it will deepen the cost-of-living crisis and further stagnate Nigeria’s economic growth.

“The increase in VAT is set to become the blazing inferno that will consume the very essence of our people. President Bola Tinubu, alongside his coterie of advisers, has resolved to raise the VAT rate from 7.5% to 10%, even as the NNPCL has announced a soaring PMS prices increase at the pump,” Atiku stated.

“This move unveils a new era of regressive and punitive policies, and its impact is destined to deepen the domestic cost-of-living crisis and exacerbate Nigeria’s already fragile economic growth.”

READ ALSO: Nigeria: Top 10 Performing Sectors By VAT Contribution In Q1 2024

He said the president and his team are imposing burden on the people who are already impoverished while “ignoring their extravagant excesses!”

The Peoples Democratic Party presidential candidate in the 2023 election asserted that the Tinubu’s actions reflect “a profound insensitivity to the plight of the less fortunate”, citing cases of extravagant spending by the presidency in the face of acute economic hardship in the country.

“One need not be an economist to grasp the ominous implications of President Tinubu’s ill-conceived policies for Nigeria’s future,” Atiku further stated.

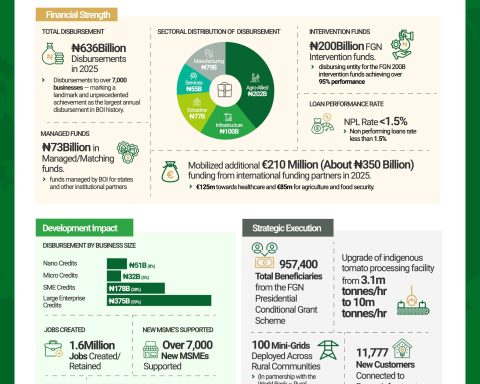

He expressed concerns that the continued increases in taxes and interest rates have gravely impacted businesses of all sizes, leading to job losses and exacerbating the suffering of the poor in the country.

The former vice president said the manufacturing sector has endured negative impact of the government’s policies since Tinubu assumed office last year, adding that according to report by the National Bureau of Statistics (NBS), the sector’s contribution to the GDP has diminished by over 20% since December 2023.

Atiku also faulted Tinubu’s policy on duty-free importation of agricultural commodities such as wheat, maize, and paddy. According to him, the import waiver would hamper local agricultural production and threatens food security and job creation in the country.

“This policy poses a grave threat to Nigeria’s food security ambitions, as local farmers, facing unfair competition from low-cost producers in Asia, Europe, and America, are compelled to reduce or entirely abandon their production efforts. It jeopardizes job creation, wealth generation, and the sector’s long-term prosperity, casting a shadow over Nigeria’s sustainability and development.”

He urged the president and his advisers to shift their focus towards creating policies that offer sustainable solutions to challenges affecting the economy.

As part of efforts to reform the country’s tax system, President Bola Tinubu had in August 2023, set up a tax and fiscal policy committee headed by Taiwo Oyedele.

Mr Oyedele had in May this year, while emphasising the need to increase VAT from 7.5 per cent to 10 per cent, said the committee proposed adjusting the sharing formula for VAT because it is a tax of the states.

Currently, as provided in section 40 of the VAT Act, the federal government gets 15 percent of the tax revenue, states share 50 per cent, and local governments share the balance of 35 percent.

Oyedele said the committee is recommending reduction of the federal government’s share from 15 percent to 10 percent.

Prime Business Africa recalls that the federal government increased VAT from 5 per cent to 7.5 per cent on 1 February 2020.