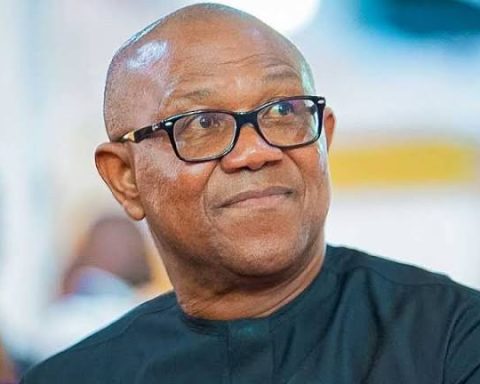

The Central Bank of Nigeria (CBN) fixed foreign exchange (forex) rates could end next year, as Presidential candidate of the Labour Party, Peter Obi, said the controlled price must be stopped, arguing that it doesn’t reflect reality.

Obi said the fixed forex rate is a fluke, and it’s time for the government to allow forces of demand and supply to determine the movement, rather than the central bank controlling the rate of international currencies.

Join our WhatsApp ChannelAccording to Obi in a statement posted on Sunday, on Twitter, “The truth is that for long market forces have not determined the exchange rate of the Naira. The two tier foreign exchange regime is a fluke. It has to end. Let the exchange rate be determined by the forces of demand and supply. It is that simple.”

He advised the government to maintain private sector partnership to reduce unemployment, as well as expand access to funding for small and medium businesses in Nigeria. Obi also stated that he will protect startups during his tenure, and protect foreign investors.

“Government must continue to collaborate with the organized private sector in this regard. Creating the enabling environment for raising employment must start with expanding the SMEs cluster via unfettered access to funding.” The former governor of Anambra State said.

In the statement, the former chairman of Fidelity Bank, said, “Flutterwave, on its own, was recently valued at US$3 billion. We will create an enabling environment for our startups to thrive.”

He added that, “Beyond creating access to easy funding, We will enforce the legal framework protecting foreign investors and their indigenous partners. This is the only way to improve our business environment and tamper capital flight.”

Meanwhile, with Nigeria’s debt profile hitting N41.6 trillion by Q1 2022, rising from N39.56 trillion recorded in December 2021, Obi suggested that the government must stop borrowing for consumption, and “All loans must be invested in regenerative projects.

“Inflation is a factor of spending on goods and services outstripping production. Since we have not resolved the minimum wage issue, we will not use wage and price controls to fight inflation.

“Rather, we will pursue a contractionary monetary policy. We will mop up excess liquidity by reducing the money supply within an economy.” The statement reads.