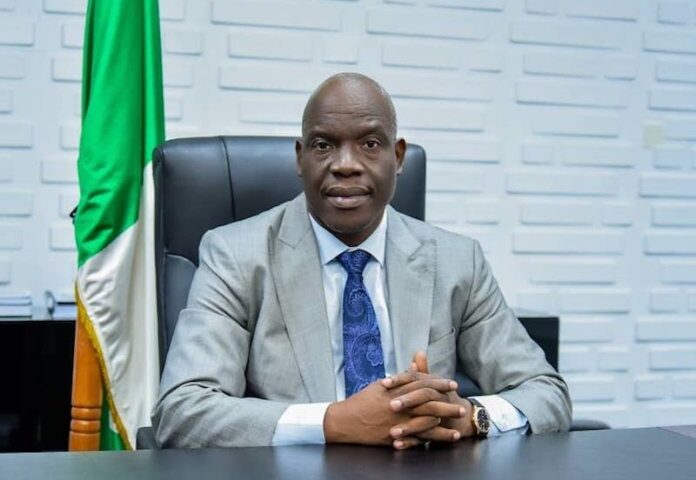

THE Group Managing Director of the Nigerian National Petroleum Corporation (NNPC), Mr. Mele Kyari, has justified Federal Government’s decision to have 20% equity stake in Dangote refinery.

Kyari said it was a well-calculated decision that would favour the country.

Join our WhatsApp ChannelThe NNPC GMD stated this when he appeared before the House of Representatives Committee on Finance’s interactive session on the 2022 – 2024 Medium-Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) on Wednesday.

The Federal Executive Council (FEC) had earlier this month approved the acquisition of 20% stake by the NNPC in Dangote Petroleum and Petrochemical Refinery in the sum of $2.76bn.

Kyari explained that the NNPC’s equity stake in Dangote refinery was strategic in the sense that it was tied to the company buying crude oil from Nigeria.

According to him, the arrangement is a strategic way of selling Nigeria’s crude oil, as Dangote refinery can import cheap crude from other countries and refine.

Read also: 20% Of Dangote’s Refinery To Be Acquired By FG For $2.76bn

“We structured our equity participation that this refinery must buy at least 300,000 crude from us. This guarantees your market,” Kyari said.

He described the decision as a very conscious one.

He said, “Our decision to take equity in the Dangote refinery was a very, very calculated and conscious decision. First, there is no resource-dependent country like ours anywhere, and with a national oil company, will have a venture of this size and magnitude with its very clear security implications that is situated in a free trade zone. Literally, this refinery is not in this country.

“Secondly, this company is situated in the free trade zone. The meaning of this is that there are several incentives granted to this business. If you look at our investment, total investment, of about $2.7bn, if you are to build 20% of that capacity, which will be around 130 barrels per day capacity refinery.

“It is simply impossible to build a refinery of that capacity with that amount of money. This is not just a refinery, but a refinery with a petrochemical component.”

The GMD who stated that Nigeria rely heavily on importation of 100% of petroleum products consumed in the country, noted that the refinery would produce close to 50 million litres of petroleum product that would help in meeting local demand to a certain extent.

“Today, we import 100% of our refined products into this country. You now have a venture that will produce close to 50 million litres of petroleum products in this country, While energy security is an issue in every country including the United States of America. I have personal knowledge that they keep stock of petroleum products on the ground that government owns it, and government pays for it and keeps it,” Kyari stated.

He disclosed that the country had no strategic storage, adding that the equity stake would ensure that the country had a seat on the board of the company.

“As we speak today, we don’t have any strategic storage or arrangement. So no country will allow venture of this nature to exist without having a sit on the board of a company like this,” he said.

He also disclosed that the Federal Government would borrow money from Afrexim bank to make the initial equity payment, while tying the subsequent payment to the company buying crude oil from NNPC.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.

Follow Us