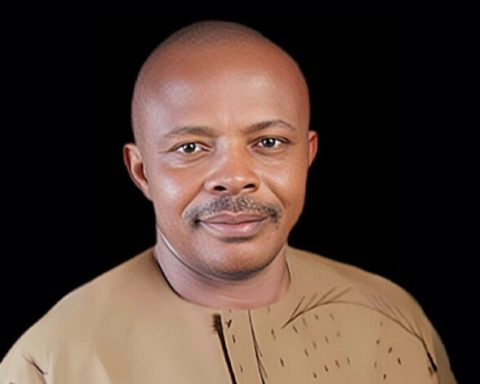

The President of the Nigeria Labour Congress (NLC), Joe Ajaero, has warned that another increase in the fuel price will lead to an indefinite nationwide shutdown.

Ajaero made the warning at the African Trade Union alliance meeting in Abuja, on Monday, after reports emerged that the oil marketers are considering raising the price of Premium Motor Spirit (PMS), also known as petrol.

Join our WhatsApp Channel“As we’re here now. They’re contemplating on increasing the pump price of petroleum products. But the Minister of Labour for some time now, will only go to Minister of Justice to come up with injunction to hold the hands of labour not to respond. They have started floating ideas of a likely increase in the price of petroleum products.

“But let me say this. Nigerian workers will not give any strike notice. If we have not addressed the consequences of the last two increases of fuel pump price, and we wake up from sleep to hear that they have tampered with the fuel pump price again.

“I want to plead with government that those bad economic policies that make our wages next to nothing, should be checked. If you check those policies that lead to inflation, and devaluation of the currency, we will be comfortable even where we are. If naira is at par with dollar today, we will ask you to leave minimum wage at 30,000,” Ajaero said.

Recall that the National Public Relations Officer, Independent Petroleum Marketers Association of Nigeria (IPMAN), Chinedu Ukadike, disclosed that the price of fuel could rise from N580 to fall between N680/litre and N750 per litre.

Ukadike said the pump price could be adjusted upward in the coming weeks due to the fluctuation of the exchange rate between the naira and the dollar.

Breaking down the possible adjustment, Ukadike said, with the exchange rate falling between N910 to N950 in the black market, the fuel price could go up to N680/litre and N720/litre.

He also revealed that should the dollar rate rise to N1000/$1, the price of fuel at petrol stations could hit N750 per litre.

He said the private filling stations will not adjust their pump price until the Nigerian National Petroleum Company (NNPC) Limited changes its price.

“Once there is a slack in the naira against the dollar, there is going to be an effect. The demand and supply of forex is a key factor. We should also understand that it is not only petroleum products that use forex.

“Other manufacturers who import one thing or the other are also searching for dollars. So, the surge for dollars has continued to increase. So now that the dollar is hitting N910 to N940, and approaching N1,000, you should expect to buy PMS at the rate of N750/litre.

“It is simple mathematics, once the dollar is going up, have it in mind that the prices of petroleum products would definitely increase because the products are dollar-driven,” he said in a report by Punch earlier on Monday.