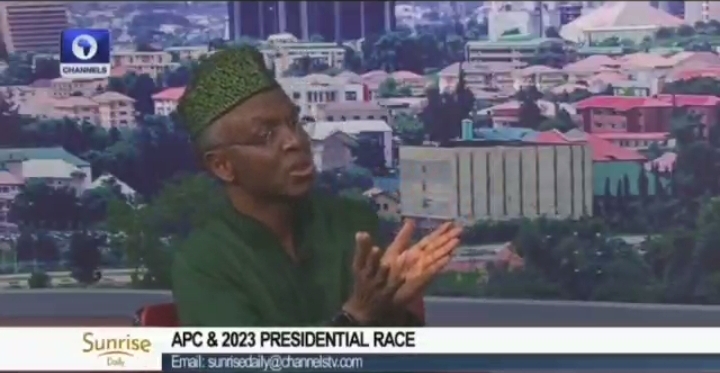

The founder of the Centre for the Promotion of Private Enterprise (CPPE), Muda Yusuf, said sectors driven by cash are struggling with the transition from old Naira notes to redesigned banknotes.

Yusuf identified the distributive trade sector and the agricultural sector as two major industries significantly impacted by the unavailability of the local currency caused by the short deadline to transition.

Join our WhatsApp ChannelThe former Director-General of the Lagos Chamber of Commerce and Industry (LCCI) made this known during a Twitter space organised by Prime Business Africa this week.

Recall that Prime Business Africa had reported that the Central Bank of Nigeria (CBN) gave 31, January, 2023, as the deadline to phase out the old N200, N500 and N1,000 banknotes after releasing the redesigned notes in December 2022.

The two-month notice has caused chaos in the banks and locations of Auto Teller Machines (ATM), as Nigerians are unable to withdraw the new Naira notes due to insufficient banknotes.

With Nigerians unable to lay their hands on cash, businesses have been disrupted, and Yusuf said the most impacted are distributive trade and the agricultural markets because they are dominated by players in the informal sector.

He explained that Nigeria’s economy will bear the brunt of the trade disruption, as distributive trade is about 14 per cent of the country’s Gross Domestic Product (GDP) and Agric accounts for about 25 per cent of the GDP.

“The sectors that are most vulnerable in this cash and swap thing, and this scarcity of new notes are the distributive trade sector and the agricultural sector.

“I’m not saying other sector are not vulnerable, distributive trade is about 14 per cent of our GDP, Agric is about 25 per cent of our GDP.

“These two sectors are driven largely by cash. Because they are also dominated by the informal sector players. So to the extent that these sectors have been massively disrupted,” Yusuf said.

The economist also disclosed that the manufacturing sector will also be impacted, as manufacturers have to sell what they produced.

“It has a knock-on effect even on the manufacturing because whatever you produce, you have to sell. And if there is a crisis in the marketplace, how are you going to sell your product? And you can see the crisis all over the place,” he said.