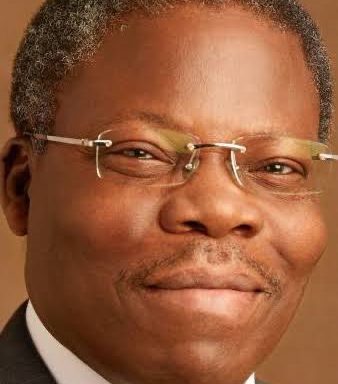

The Director-General of government agency, Bureau of Public Enterprises (BPE), Alex Okoh, has criticised comments by the sacked owners of Benin, Kano, Kaduna and Ibadan Distribution Companies (DisCos).

Last week, Fidelity Bank had moved to retrieve its loan obtained by the former owners, taking over their shares in the DisCos, due to their inability to refund an undisclosed amount loaned to the investors.

Join our WhatsApp ChannelFollowing the outburst from the DisCos investors, labelling their ouster as illegal, Okoh said the electricity distribution companies performed at their worst under the former owners.

He specifically mentioned Ibadan DisCo, saying the head was inexperienced to run the electricity distribution company, “It must be reiterated that some of the publications from the Core Investors of these DISCOs have been quite disingenuous.” He said in a statement.

According to Okoh, the financial issues are not the only problems faced by the DisCos, but the electricity companies also have management difficulty before they were disengaged.

“the DISCOs affected happen to be the worst-performing ones. Ibadan is currently being managed by a so-called Receiver Manager as a sole administration. The Receiver Manager has absolutely no capacity to manage a utility and has not been authorised by the Regulator as a manager of a DISCO.

“Ibadan is the worst performing DISCO as per the Performance Assessment review conducted in December 2021. Ibadan DISCO has actually retrogressed in terms of their critical performance parameters as contracted in the Performance Agreement signed with the Bureau.

“In fact, the DISCO under the management of the Core Investor, Integrated Energy Distribution and Marketing Limited (IEDM), has performed worse than before it was privatized”. Okoh said in the statement.

Meanwhile, the BPE DG reiterated that Fidelity Bank would not be allowed to keep the electricity distribution companies under the firm, as other private investors will be sought to takeover the DisCos.

“It is envisaged that the majority interest in these DISCOs would be sold to competent private sector investors with the requisite technical and financial capacity to re-capitalize and manage these entities efficiently.

“As an interim measure, NERC and BPE met on an Emergency Basis and activated the Business Continuity Process and appointed interim Managing Directors in the affected DISCOs as follows: Kano DISCO – Ahmad Dangana; Benin DISCO – Henry Ajagbawa; Kaduna DISCO – Yusuf Usman Yahaya.” The statement reads.