Nigeria loses at least 700,000 barrels of crude oil to thieves per day, the Minister of State for Petroleum Resources, Timipre Sylva, has revealed. This compounds the revenue problem of the country.

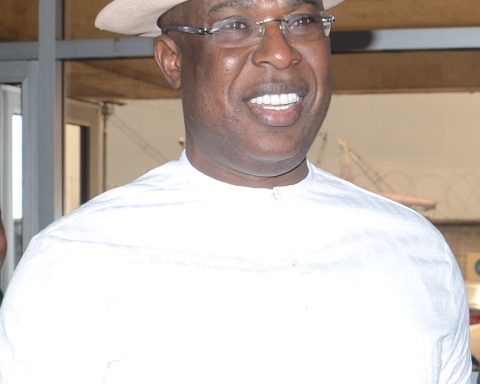

According to Sylva, “Oil theft has denied the country of an estimated 700,000 barrels of crude oil per day. The adverse effect of this is the drop in the production of crude oil and decline in the national income.”

Join our WhatsApp ChannelHe revealed this during the Petroleum Training Institute students’ 2002 graduation (PTI) in Effurun, Delta State over the weekend.

Prime Business Africa (PBA) understands the loss of 700,000 barrels of crude oil to thieves per day means the country loses $63 million oil earnings daily or about $1.9 billion monthly based on an average price of $90 per barrel.

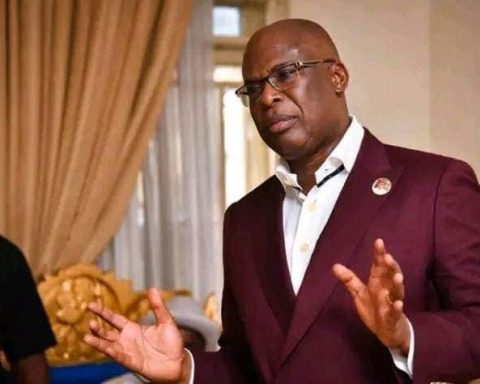

The volume of barrels lost according to Sylva is more than the 600,000 barrels the Nigerian National Petroleum Company Limited (NNPC) Group Chief Executive Officer, Mele Kyari, said weeks ago when the oil corporation uncovered an illegal 4-kilometre (km) pipeline.

It was gathered that the illegal 4-kilometre pipeline, which stretches from Forcados terminal to the sea, had been in operation for nine years. Although Kyari said oil theft has been going on for over 22 years.

He, however, admitted that the illegal practice has recently hit an unprecedented rate. Kyari further stated that, “As a result of oil theft, Nigeria loses about 600,000 barrels per day, which is not healthy for the nation’s economy, and in particular, the legal operators in the field, which had led to a close down of some of their operational facilities.”

The activities of oil thieves have continued to drag the revenue Nigerian government generates from oil down. PBA had reported that Nigeria’s oil revenue will lose N1.24 trillion in 2023.

This is according to the oil revenue projected by President Muhammadu Buhari during his 2023 budget presentation, where he said Nigeria will generate N1.92 trillion oil revenue next year, below the N3.16 trillion projected for 2022.