Nigeria’s headline inflation dropped sharply to 16.02% in October 2025 from 18.02% in September, marking the steepest monthly decline in 2025, according to a policy brief by the Centre for the Promotion of Private Enterprise (CPPE).

The decline reflects base effects from last year’s high inflation, sustained naira stability, and improved macroeconomic coordination.

While the overall moderation is encouraging, inflationary pressures remain elevated in critical household sectors. including food, transport, housing, utilities, education, and health which together account for 84% of the country’s inflation burden.

Join our WhatsApp ChannelREAD ALSO: CPPE Warns Suspension of 15% Fuel Import Duty Threatens Nigeria’s Refining Industry, Energy Security

CPPE Highlights What Must Be Done To Sustain Disinflation In Nigeria

These sectors continue to exert the strongest direct impact on the cost of living for households and on production costs for businesses.

Key drivers of the October disinflation include:

- Base Effects: With October 2024 inflation at 33.8%, the high reference point contributed to a statistical decline in year-on-year inflation.

- Exchange Rate Stability: Modest appreciation and sustained stability of the naira helped reduce imported inflation, especially in sectors reliant on imported inputs and energy.

- Improved Macroeconomic Coordination: Measures including monetary tightening, better FX market liquidity, reduced speculative demand for foreign currency, and positive investor sentiment collectively strengthened price stability.

Despite these gains, structural factors continue to sustain price pressures across the economy. High logistics costs from poor roads, elevated diesel prices, and port inefficiencies raise transportation costs.

Energy deficits, high tariffs, and reliance on generators increase production expenses. Limited access to affordable credit and persistently high lending rates constrain business growth.

Additional pressures include climate-related disruptions, such as floods and droughts affecting agricultural output, insecurity in food-producing regions, informal cross-border food exports due to currency differentials, and low youth participation in agriculture all limiting the speed at which disinflation translates into real cost-of-living relief.

CPPE recommended targeted interventions to consolidate gains, including expanding climate-resilient agriculture, improving storage and logistics infrastructure, enhancing rural security, rehabilitating key transport corridors, stabilizing energy supply, and expanding access to low-cost financing for SMEs and farmers.

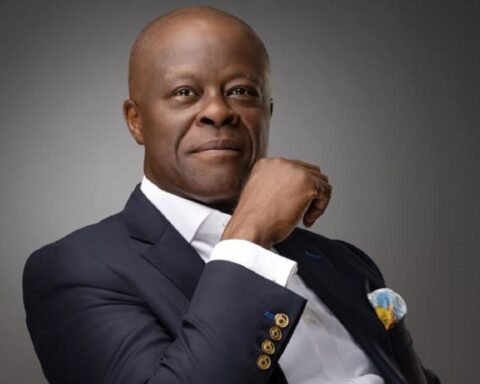

Dr. Muda Yusuf, CPPE CEO, emphasized: “Coordinated fiscal, monetary, and structural reforms are essential to ensure that lower inflation translates into tangible relief for households and strengthens business confidence.”

The October inflation moderation signals improving macroeconomic stability. However, without accelerated structural reforms, businesses and households may continue to face high sector-specific costs, limiting broader economic growth and investment opportunities

Amanze Chinonye is a Staff Correspondent at Prime Business Africa, a rising star in the literary world, weaving captivating stories that transport readers to the vibrant landscapes of Nigeria and the rest of Africa. With a unique voice that blends with the newspaper's tradition and style, Chinonye's writing is a masterful exploration of the human condition, delving into themes of identity, culture, and social justice. Through her words, Chinonye paints vivid portraits of everyday African life, from the bustling markets of Nigeria's Lagos to the quiet villages of South Africa's countryside . With a keen eye for detail and a deep understanding of the complexities of Nigerian society, Chinonye's writing is both a testament to the country's rich cultural heritage and a powerful call to action for a brighter future. As a writer, Chinonye is a true storyteller, using her dexterity to educate, inspire, and uplift readers around the world.