As the world endures biting hardship, inflation, and high transportation costs, every institution, including financial institutions, should be reliable. As people steadily see the government as a failure, such dilemma should not also fall upon them. Currently, wise financial and saving decisions have become paramount; without exchange, no one will survive.

Current situations with banks and customers

It is no news that customers of Nigerian banks frequently complain about transaction failures, excessive charges, poor customer service, access issues, and digital banking problems. Many experience failed transactions with funds deducted without completion, leading to frustration. This sentiment has been echoed across various social media platforms, where users share their negative experiences with banking services. Reports indicate that 40% of failed electronic payment transactions remain unresolved. A motion presented in the House of Representatives on 12 March 2024, revealed that over 69% of complaints received by banks were related to failed transactions.

Join our WhatsApp ChannelIn the wake of economic hardship, Nigerian banks must resolve customer issues to maintain trust and stability. Addressing complaints enhances customer satisfaction, fosters loyalty, and prevents attrition. Improved service delivery builds confidence among investors and depositors, contributing to overall economic stability and aligning with regulatory expectations for a resilient banking environment.

Perhaps the challenges suffered at the hands of Nigerian banks have led many individuals to willingly turn to online services like Opay and PalmPay due to the convenience, speed, and accessibility they offer, especially during economic hardship when traditional banking may be less reliable.

However, online services have their own peculiar challenges, including a lack of physical locations that can hinder customer support and trust. Additionally, security concerns and technical issues—such as app crashes and slow response times—complicate user experiences. The stress of approaching banks for savings may be why many older people prepare savings in wooden boxes or bury them underground like in ancient days.

Banks’ Challenges

While it is not fair to conclude that banks are not doing anything about the perplexing situation—since they are striving to provide reliable services amid economic hardship—they face significant challenges too. First Bank, for instance, is recognised for its strong customer service and digital presence. GTBank excels in innovative digital banking solutions. Others such as Access Bank have established themselves as leaders in financial inclusion by offering diverse banking products to meet customer needs.

Nigerian banks also struggle with inadequate infrastructure, high operational costs, and non-performing loans. Frequent power outages force banks to rely on costly generators, while poor network connectivity hampers digital transactions, leading to customer frustration. Regulatory pressures further strain resources, making innovation difficult. Economic instability characterised by fluctuating exchange rates and inflation undermines customer confidence.

However, banks must enhance their efficiency or risk losing customers to fintech solutions like Opay and PalmPay. If not, one day they will wake up to find no customers at all. It is in this respect that one bank, the United Bank for Africa, is doing something unique.

Responsibilities Versus UBA’s Touch of Class

In today’s volatile economic climate marked by rising inflation and fluctuating currency values, banks must provide reliable access to credit, and UBA plays a key role by offering affordable loans and credit facilities. It has products for unbanked populations through initiatives like the Leo Chatbot, Africa’s first AI-powered banking chatbot, and the UBA Moni Agent Network that expands banking access in rural areas. Again, UBA supports SMEs through its SME Lending Program, having disbursed over ₦100 billion since 2020. This programme offers specialised financial products such as working capital loans and equipment financing, fostering business growth and contributing to Nigeria’s economic stability.

It’s All About You

According to UBA’s Sustainability Report 2023, over 15,355 people were empowered with financial knowledge through various business series initiatives in 2023. Additionally, more than 32,194 MSME customers received loans to support their businesses during the same period, showcasing the bank’s dedication to enhancing financial literacy and inclusion.

Investing in digital banking services allows banks to offer more accessible and convenient options, which is crucial during economic hardships when customers prefer online transactions over physical branch visits. UBA stands out as the bank to turn to now due to its significant investment in digital banking. UBA launched the UBA Mobile App in 2018 and Leo Chatbot in 2019. Olubunmi Kuforiyo, who operates Erika Multi-Services Limited, shared her satisfaction with UBA’s services, particularly praising their effective internet banking. She said that “the bank has been good to me so far… I enjoy the internet banking because even whenever I am out of the country it is very effective.”

READ ALSO: Banks’ Recapitalisation Will Strengthen Nigeria’s Economy – UBA GMD

Furthermore, financial literacy programmes can help citizens manage their finances, understand credit, and make informed investment decisions. UBA has made significant strides in this area with its financial education initiatives. According to reports, UBA’s National Essay Competition launched in 2011 under the UBA Foundation is one programme that has achieved this feat. The competition has reached thousands of students across Nigeria, fostering a better understanding of financial principles.

Can it be due to UBA’s Culture of Firsts?

Can one say that UBA has such strength because of its long existence? It could be in terms of management. On 23 February 1961, UBA was established to take over British and French Bank Limited. In 1970, UBA became the first Nigerian bank to list its shares on the Nigerian Stock Exchange (NSE).

In 2005, UBA’s merger with Standard Trust and its acquisition of other banks positioned it as a leading institution with extensive reach and commitment to innovation.

With a presence in over 20 African countries, customers can continue with UBA as their favourite bank even after travelling abroad. UBA is a reputable financial institution with strengths in corporate banking, retail banking, and digital services, mitigating risks for customers.

Shining Performance and Customer Testimonies

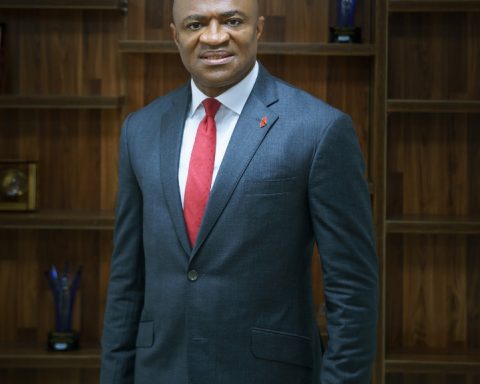

UBA’s Group Managing Director, Oliver Alawuba, who commented on the bank’s strong performance in Q1 2024 on 8 May, noted that the bank’s strategies focused on customer service and digital adoption have significantly enhanced customer satisfaction. He stated: “Our record Q1 profit before tax was delivered with triple-digit gross earnings growth… This has helped drive improvement in efficiency and customer satisfaction.” This comment is evidence that UBA has maintained its strength in customer satisfaction since its establishment.

READ ALSO: UBA Counts Achievements At 75, Envisions To Be Role Model For African Businesses

In UBA’s corporate banking sector, the bank provides finance, treasury management, and investment services. Hyacinth Okafor of Hycharis Industries Limited expressed satisfaction, stating: “I have been banking with UBA for 14 years now, and in those 14 years, the bank has done well.” Despite economic challenges, UBA reported impressive financial performance in Q1 2024 with a profit before tax of N156.34 billion—a 155% increase from the previous year.

Profit after tax also rose to N142.5 billion (165% growth), while gross earnings reached N570.2 billion—up 110%. Interest income climbed to N440.7 billion (130% increase), with total assets growing to N25.4 trillion (23% increase). Customer deposits also rose to N18.4 trillion, reflecting a similar growth rate of 23%.

READ ALSO: Your Online Retail Payments Are Getting More Protected, Inclusive – SIIPS 2023 Report

In these times of economic hardship, choosing a bank with longevity, internal strength, and geographical reach is essential. Banks must prioritise customer satisfaction, enhance service delivery, and invest in technology to remain competitive. By doing so, they can build trust and loyalty, ensuring long-term success in a challenging environment.

Dr Mbamalu is a Jefferson Fellow, member of the Nigerian Guild of Editors (NGE) and a renowned Publisher.

Dr. Marcel Mbamalu is a distinguished communication scholar, journalist, and entrepreneur with three decades of experience in the media industry. He holds a Ph.D. in Mass Communication from the University of Nigeria, Nsukka, and serves as the publisher of Prime Business Africa, a renowned multimedia news platform catering to Nigeria and Africa's socio-economic needs.

Dr. Mbamalu's journalism career spans over two decades, during which he honed his skills at The Guardian Newspaper, rising to the position of senior editor. Notably, between 2018 and 2023, he collaborated with the World Health Organization (WHO) in Northeast Nigeria, training senior journalists on conflict reporting and health journalism.

Dr. Mbamalu's expertise has earned him international recognition. He was the sole African representative at the 2023 Jefferson Fellowship program, participating in a study tour of the United States and Asia (Japan and Hong Kong) on inclusion, income gaps, and migration issues.

In 2020, he was part of a global media team that covered the United States presidential election.

Dr. Mbamalu has attended prestigious media trainings, including the Bloomberg Financial Journalism Training and the Reuters/AfDB Training on "Effective Coverage of Infrastructural Development in Africa."

As a columnist for The Punch Newspaper, with insightful articles published in other prominent Nigerian dailies, including ThisDay, Leadership, The Sun, and The Guardian, Dr. Mbamalu regularly provides in-depth analysis on socio-political and economic issues.