The Nigeria Extractive Industries Transparency Initiative (NEITI) uncovered the influx of N14.38 trillion into the nation’s federation account between 2020 and 2021.

Dr. Orji Ogbonnaya Orji, NEITI’s Executive Secretary, delivered this eye-opening report during the unveiling of the 2020-2021 NEITI Fiscal Allocation and Statutory Disbursement (FASD) Industry report.

Join our WhatsApp ChannelThe report dissected the revenue remittance, showcasing stark figures. The Nigerian National Petroleum Company Limited (NNPCL) stood out, remitting N1.55 trillion, constituting 10% of the total sum during the assessed period.

Notably, the now-unbundled Department of Petroleum Resources (DPR) – reformed into the Nigerian Upstream Petroleum Regulatory Commission (NUPRC) and Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) – remitted N2.7 billion, representing 18.83% of the total revenue.

READ ALSO: $20 Billion Needed Annually To Address Nigeria’s Gas Infrastructure Gap- NEITI

However, concerns were raised regarding the Niger Delta Development Commission’s (NDDC) expenditure of N2.41 trillion on labeled “emergency” projects, prompting scrutiny of transparency, project planning, and execution.

NEITI recommended audits for these projects, pointing out 97.71% allocated to capital projects and 2.29% to recurrent expenses, highlighting completed and ongoing projects in roads and electricity.

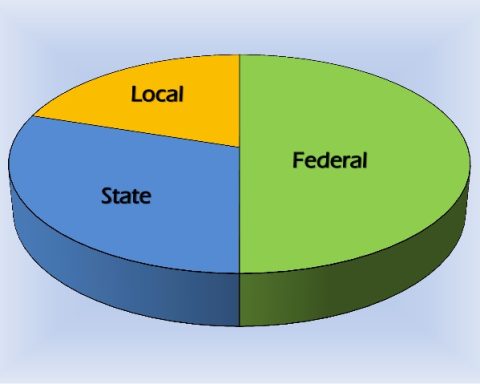

Furthermore, the report highlighted the heavy reliance of 36 states solely on the Federation Account Allocation Committee (FAAC), posing risks to their financial stability and hindering economic diversification and debt reduction efforts.

States were urged to revamp Internally Generated Revenue (IGR) strategies to mitigate this overreliance. The report also shed light on the Ministry of Mines and Steel Development, emphasizing a doubled revenue between 2017 and 2021, yet considerably lower than the sector’s potential.

NEITI recommended exploring methods to attract investments in the solid minerals sector, suggesting risk assessments and special financing options to bolster investments in this crucial area.

Dr. Orji, while emphasizing the report’s findings, stated, “Revenues from solid minerals remain abysmally low compared to the sector’s revenue potentials.”

NEITI’s strong push for diversification and transparency is a call for a reformed fiscal approach in Nigeria’s economic landscape.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.