The Nigerian Naira experienced a slight appreciation against the United States dollar in trading sessions, despite concerns over widening gaps between official and parallel market rates.

As per data from the FMDQ Securities Exchange, the local currency closed at N1,542.58 per dollar on Tuesday, marking a marginal gain from previous rates.

Join our WhatsApp ChannelHighlighting the fluctuations, currency traders expressed concerns over the volatility in the market. Abubakar Muhammed, a BDC operator in Wuse, Abuja, noted, “Today’s rate was at N1,900. We bought at N1,900/dollar and sold around N1,850 and N1,870.” This sentiment was echoed by others like Mr. Ibrahim Dabi in Lagos and Mustafa Zakari at the Lagos airport.

READ ALSO: Nigerian Govt To Raise $10bn To Boost Foreign Exchange Liquidity As Naira Falls To N1,850/$1

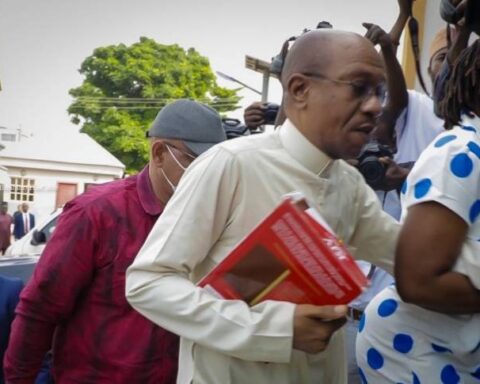

Efforts to stabilize the exchange rate have been undertaken by both the Central Bank of Nigeria (CBN) and the Economic and Financial Crimes Commission (EFCC). The EFCC recently conducted operations in the Wuse Zone 4 market to crack down on currency speculators, aiming to restore stability and boost liquidity in the forex market.

President Bola Tinubu disclosed plans to raise $10 billion to bolster forex liquidity, following the floating of the naira in June 2023. The CBN has implemented various measures to regulate the forex market, including guidelines to enhance liquidity and deter speculative activities.

Despite these efforts, challenges persist, particularly with the wide gap between intra-day rates at the official Nigerian Autonomous Foreign Exchange Market (NAFEM).

Stakeholders like Aminu Gwadabe of the Association of Bureau De Change Operators of Nigeria expressed concerns over transparency and the dominance of banks in the FMDQ Exchange.

Gwadabe stressed the need for an independent platform to ensure fairness in rate determination. He questioned the significant rate shifts following CBN directives and urged for greater transparency in trading activities.

Charles Sanni of Cowry Treasurers Limited attributed the wide gap between intra-day trading rates to inadequate forex supply, indicating underlying scarcity in the market.

While the CBN and EFCC collaborate to tackle currency speculation, details regarding transactions on the FMDQ platform remain undisclosed, raising questions about transparency and accountability in the forex market.

Efforts to obtain comments from the CBN were unsuccessful at the time of reporting. However, it remains clear that addressing the challenges in Nigeria’s forex market requires a concerted effort from regulatory bodies, financial institutions, and stakeholders to ensure stability and transparency in currency exchange operations.