THE rising pressure on the Naira has seen exchange rate for a dollar to the local currency deprecate across various market windows.

Data at the FMDQ Security Exchange where forex is traded officially shows that exchange rate between the naira and the US dollar opened at ₦414.46 /$1 on Monday, October 18, after it closed at ₦415.07 per $1 on Friday, 15 October 2021.

Join our WhatsApp ChannelAt the Bureau De Change segment, the naira opened at N570.00 to a dollar ($1), today Monday, October 18 according to traders.

The Naira/US$ exchange rate rose (Naira depreciated) by 0.79per cent at the Parallel market to close at N572.00/US$ on Friday, even as it closed flat at N380.69/US$ at the Interbank Foreign Exchange market amid weekly injections of US$210 million by the Central Bank of Nigeria (CBN) into the forex market.

However, the CBN does not recognise the parallel market (black market), as it has directed individuals who want to engage in Forex to approach their respective banks.

The Naira last week depreciated against the greenback by 0.19per cent to close at N415.07/US$ at the Investors and Exporters Foreign Exchange (FX) window despite the 3.77per cent week on week (w-o-w) accretion to the external reserves which closed at US$39.62 billion as of Thursday, October 14, 2021.

Meanwhile, for the week ended October 15, 2021, the average Nigerian Autonomous Foreign Exchange Fixing (NAFEX) was $/N413.40, compared to $/N412.98 recorded in the previous week ended October 8, 2021, representing a depreciation of the Naira against the United States (US) Dollar by 0.10 per cent ($/N0.42).

(See Table 1 below)

Table 1: Weekly FX Rate Analysis

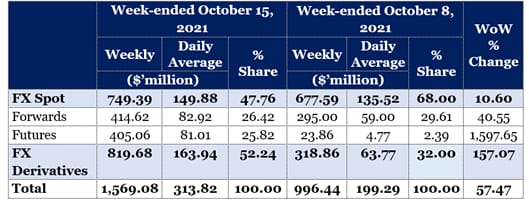

In its weekly commentary on the Foreign Exchange (FX) market with data for the week ended October 15, 2021, FMDQ, a Dealing Member (Banks) /Authorised Dealers) and their clients compare weekly turnover for trades between banks for the weeks ended October 8 & 15, 2021.

In the foreign exchange,(Forex) Spot and Derivatives markets, the total turnover for the week ended October 15, 2021, was $1,569.08 million, representing an increase of 57.47per cent ($572.63 million) from $996.44 million reported for the week ended October 8, 2021. According to the FMDQ data, the week-on-week (WoW) increase in total turnover was driven by the 10.60per cent ($71.81 million) and 157.07per cent ($500.83 million) increases in Forex Spot and FX Derivatives turnover, respectively.

(See Table 2 below)

Table 2: Weekly FX Turnover Analysis

THE WoW increase in Forex Derivatives turnover was driven by the 1,597.65per cent ($381.21 million) increase in Forex Futures turnover In the Forex Spot market, the total value of transactions for the week ended October 15, 2021, was $749.39 million, representing an increase of 10.60per cent ($71.81 million) from the value of transactions executed in the week ended October 8, 2021 ($677.59 million).

Similarly, in the Frex Futures market, $405.06 million worth of Forex Futures contracts were traded in six (6) deals, representing a WoW increase of 2,626.46per cent ($390.21 million) when compared to $14.86 million FX Futures contracts traded in three (3) deals recorded in the week ended October 8, 2021