Following the protest and destruction of banks’ facilities across the nation over scarcityn of new naira notes, the Chartered Institute of Bankers of Nigeria (CIBN) has urged Nigerians to remain calm, assuring that banks will remain open to attend to their customers as long as it is safe to do so.

CIBN said it is liaising with the body of banks’ CEOs to address the current challenges posed by the naira redesign policy of the Central Bank of Nigeria (CBN).

Join our WhatsApp ChannelIn a statement signed by the President/Chairman of Council, CIBN, Ken Opara, on Friday, the umbrella professional body for bankers in Nigeria said that commercial banks will continue to ensure the provision of adequate security in all branches, for hitch-free operations.

READ ALSO: Naira Scarcity: 17 Bank Branches Attacked, Bank Workers Threaten Strike

Opara, however, indicated that banks have been “empowered to take proactive measures to close their operations,” and inform the CBN whenever there is a security challenge in any of their locations to avoid attacks on staff and further destruction of assets and facilities.

The statement reads: “The Chartered Institute of Bankers of Nigeria is liaising with the Body of Banks CEOs to address the current challenges. As such, the banks would continue to remain open to serve the public as long as it is safe to do so.

“The safety and security of staff of banks is of paramount importance. Hence, where there is security challenge, the Management of banks have been empowered to take proactive measures to close their operations in such location and inform the Central Bank of Nigeria. Therefore, the safety concerns being expressed in various quarters are already being addressed.

“Banks will continue to ensure that adequate security is in place to protect staff and customers whilst safeguarding their assets in contending with the current challenge. Consequently, we appeal to the general public to remain calm and eschew any act of violence as the banking industry remain resolute and committed to finding ways to address all the related issues.

“We indeed appreciate your continued patience and understanding as we work together towards restoring normalcy.”

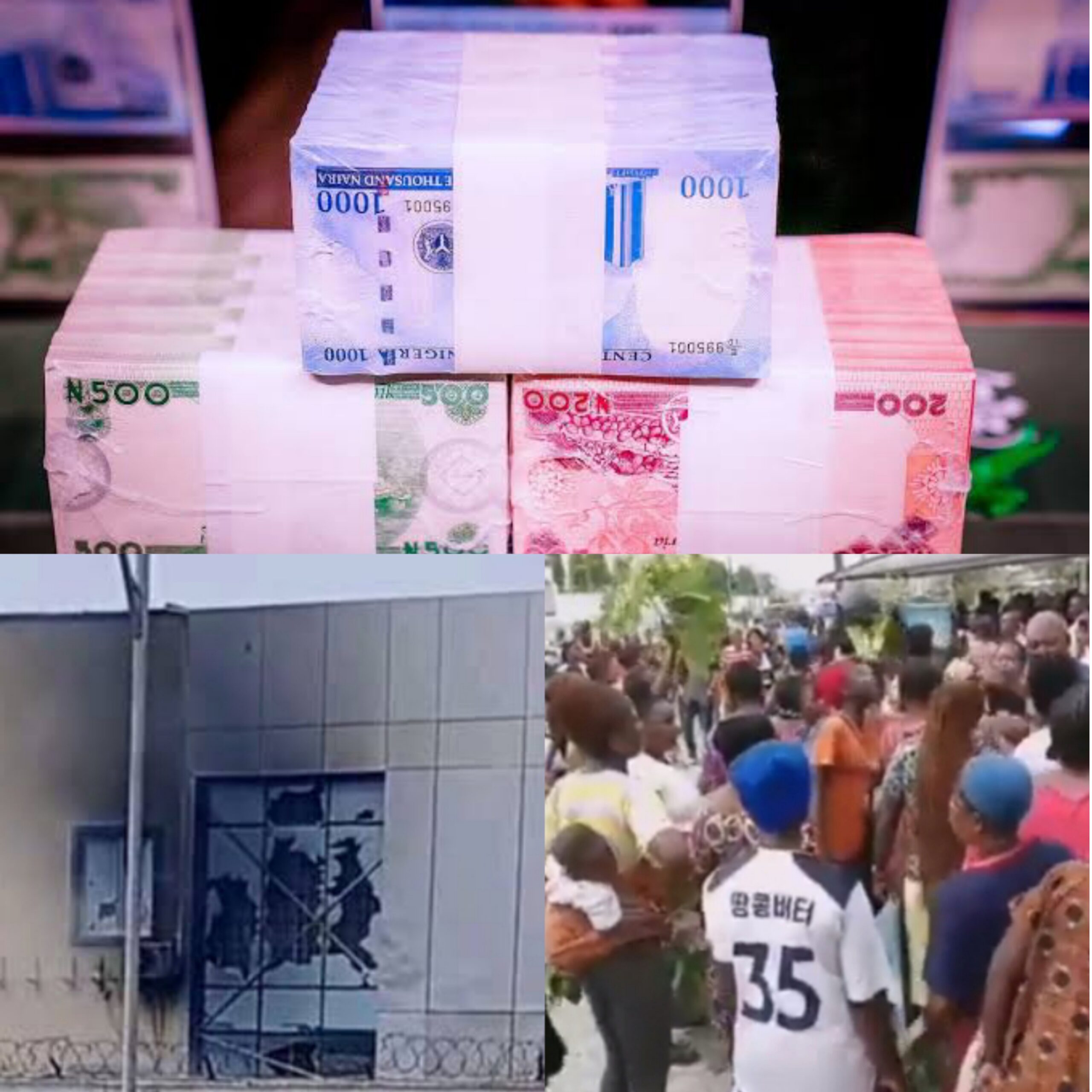

The lingering scarcity of the new currency notes (N1,000, N500, and N200) has forced Nigerians to embark on protests in different parts of the country in the last one week. The protests have led to attacks and burning of banks’ branch offices in states like Oyo, Ogun, Edo, Ondo, Delta, Kwara, Lagos, and Enugu, among others.

READ ALSO: Naira Scarcity: Angry Warri Youths Attack First Bank, Burn Access Bank

According to the Association of Senior Staff of Banks, Insurance and Financial Institutions, (ASSBIFI, no fewer than N5 billion have been lost due to the destruction of about seven bank branches in the violent protests.

President of ASSBIFI, Olusoji Oluwole, gave the figure on Thursday, 16th February while briefing newsmen on the impact of the upsurge of violence over the scarcity of new naira notes.