Moody’s Investors Service, a global rating agency, has shifted Nigeria’s credit outlook from stable to positive, heralding a potential reversal in the country’s fiscal and external decline due to robust government reforms.

Announced on Friday, December 8, 2023, Moody’s attributed this upward shift to governmental measures like the devaluation of the naira and the removal of oil subsidies.

Join our WhatsApp ChannelAnalysts Lucie Villa and Matt Robinson highlighted these reforms as factors leading to the upgrade.

“The positive outlook reflects the possible reversal of the deterioration in Nigeria’s fiscal and external position as a result of the authorities’ reform efforts,” wrote Villa and Robinson.

READ ALSO: 2024 Budget: Tinubu Projects 21.4% Inflation In 2024 Fiscal Year Amidst Economic Reforms

Despite this optimistic change, Moody’s maintained Nigeria’s long-term issuer ratings at Caa1, cautioning that while structural reforms show promise, the nation’s fiscal and external positions remain weak.

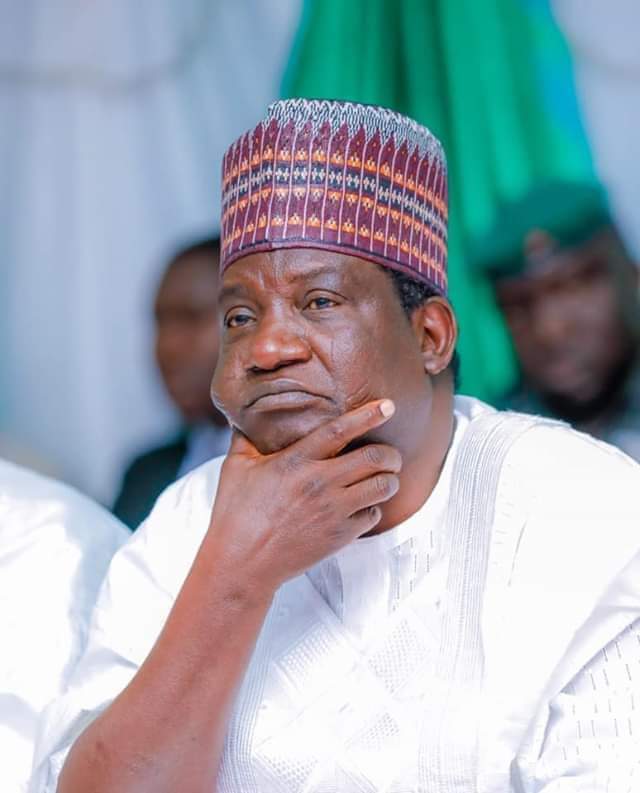

The credit agency’s assessment underscores the potential impact of President Tinubu’s reforms on Nigeria’s economic trajectory, hinting at a possible turnaround in the country’s economic outlook.

However, the decision to retain the Caa1 rating signals lingering concerns about Nigeria’s credit profile, attributed to weak fiscal and external standings, aggravated by challenges in managing the foreign exchange market.

Nigeria continues to grapple with a persistent inflation rate of 27.33% over nearly two decades, with food inflation soaring at an alarming 31.52%, among other concerning economic indicators.

The country is estimated to allocate at least six times more towards servicing its debts, highlighting the ongoing economic strain despite the positive outlook shift by Moody’s.

The onus now lies on Nigeria’s sustained implementation of comprehensive reforms to bolster its fiscal and external positions, critical for maintaining and further improving its creditworthiness on the global stage.