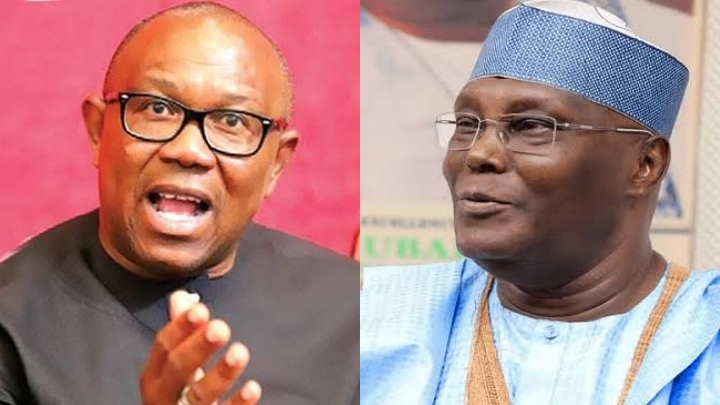

Peter Obi and Atiku Abubakar, the presidential candidates of the Labour Party and Peoples Democratic Party (PDP) have hired at least 39 Senior Advocates of Nigeria (SAN) to counter the declaration of Bola Tinubu as the President-elect.

Prime Business Africa had reported seven days ago that the Independent National Electoral Commission (INEC) announced Tinubu, the candidate of the ruling party, All Progressive Congress (APC), as the winner of the 2023 Presidential election held on 25 February 2023.

Join our WhatsApp ChannelThe announcement of Tinubu as the President-elect has been rejected by the three major contenders, including the presidential candidate of the New Nigeria People’s Party (NNPP), Rabiu Kwankwaso.

Tinubu was declared the President-elect after securing 8.79 million votes, Atiku garnered 6.98 million votes, and Obi, as well as Kwankwaso, recorded 6.10 million and 1.47 million respectively in the election that was marred by violence, killings and result falsification.

The rejection of the outcome of the presidential election has led to Atiku and Obi engaging the services of 19 and 20 lawyers respectively.

This indicates Nigerians will witness a long court battle before 29 May 2023, when the incumbent President Muhammadu Buhari is expected to hand over to the winner of the 2023 presidential election.

Aside from the court battle, some Nigerians are also beating the drum of protest, which could lead to a clash between the supporters of the candidates and explode into chaos, affecting the business environment in Nigeria – already, Atiku led members of the PDP in protest to INEC’s headquarters in Abuja.

The opposition is divided on which path to take, place their faith in the judiciary system of Nigeria and take the bull by the horn and forcefully overturn the result through protests.

Whichever road is taken by the aggrieved candidates and their supporters, it will have an effect on investors’ confidence, and in turn, affect the economy of Nigeria, which the Central Bank of Nigeria (CBN) has said will grow at a slow pace, with a growth rate of 2.88 per cent.

Both the International Monetary Fund (IMF) and the World Bank disagreed on the growth rate of Nigeria for this year, as the former estimated 3.2 per cent, and the latter projected that Nigeria’s economy will depreciate this political year to 2.9 per cent, below the 3.1 per cent growth of 2022.

In recent years, Nigeria has been struggling to shore up its capital importation (Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI)), as investors’ confidence declined between 2019 and 2022.

In 2019, Nigeria recorded $23.71 billion in capital importation, this figure fell significantly to $9.68 billion in 2022. The next year, the amount depreciated further to $6.7 billion.

Between January to November 2022, the capital inflow dwindled to $4.89 billion, corresponding with the economic downturn influenced by the COVID-19 pandemic and global economic lockdown, as well as some policies of the Nigerian government that backfired.

In 2021, Nigeria’s economic growth rate was 3.6 per cent, coming out of the 2020 recession, but fell to 3.1 per cent last year, and according to the projections by the CBN, IMF and the World Bank, the country’s economy will nosedive further this year, and won’t record growth in 2024, based on the World Bank’s forecast.

Although the CBN has stated that the buildup to elected public office holders will negatively impact the economy’s growth rate this year, the equity market or FPI – another channel where foreign and local investors invest in the country – has been able to avoid the impact of the political tension in the first quarter (Q1) 2023, as equity investors maintained their faith in Nigeria as an investable economic environment.

In the first quarter of this year, the period of the Presidential election, the Nigerian stock market grew by 7.76 per cent or 4,008.28 basis points year-to-date, nearing the height recorded during the corresponding year of 2022, when the Nigerian bourse posted 8.74 per cent.

However, how long this confidence in Nigeria’s growth prospect will last is determined by the path taken by the candidates aiming to reclaim what they described as a “stolen mandate.”

According to Portfolio Manager at AXA Investment Managers, Regina Nwangele, a protest against the INEC result could impact investors’ confidence, triggering a sell-off.

She told our correspondent that a normal legal process will not change the course of the investors currently experienced in the capital market.

“What if the opposition party decides to go to court to object whatever result we have currently? The truth is that if they go through the normal legal process, it might not necessarily change the direction of the market because the market will follow through with the information and that would guide the activity but when you expect to see the major form of reaction,” Nwangele said.

She added that: “Once it involves protest” it automatically becomes a whole different situation, “And we’ll see a whole lot of sell off in the market. So it’s easy to say that I want to give in to fight Tinubu, you also need to be careful.”

Cowry Asset Management Limited’s analyst, Charles Abuede, said the outcome of the presidential election and the National Assembly would result in both headwinds and tailwinds.

He opined that the court proceedings will act as a factor in investors’ confidence and the Foreign Direct Investment or capital importation into Nigeria’s economy.

“Well, everyone is keen on what the next move from Nigeria’s political space and how it will drive policy directions. The outcome of the recently conducted presidential and national assembly elections may have created some headwinds and on the other hand, a tailwind on the macros but does not dispute the fact that the outcome of the court proceedings will act as a factor on investors’ confidence and will speak volume on the strength of the leadership, judicial and electoral process in Nigeria. The outcome will point to the direction of FDI into the economy.”

Follow Us