Nigerian cement manufacturers reported sales worth over N2.35 trillion in 2022, recording a 21.64 per cent rise in gross earnings, but thanks to Dangote Cement, the industry suffered a decline in net profit.

Prime Business Africa’s cement sector analysis showed that the cement market, which is led majorly by Dangote Cement, BUA Cement and Lafarge, generated N418.50 billion more in revenue last year when compared to the over N1.93 trillion Nigerians spent on cement in 2021.

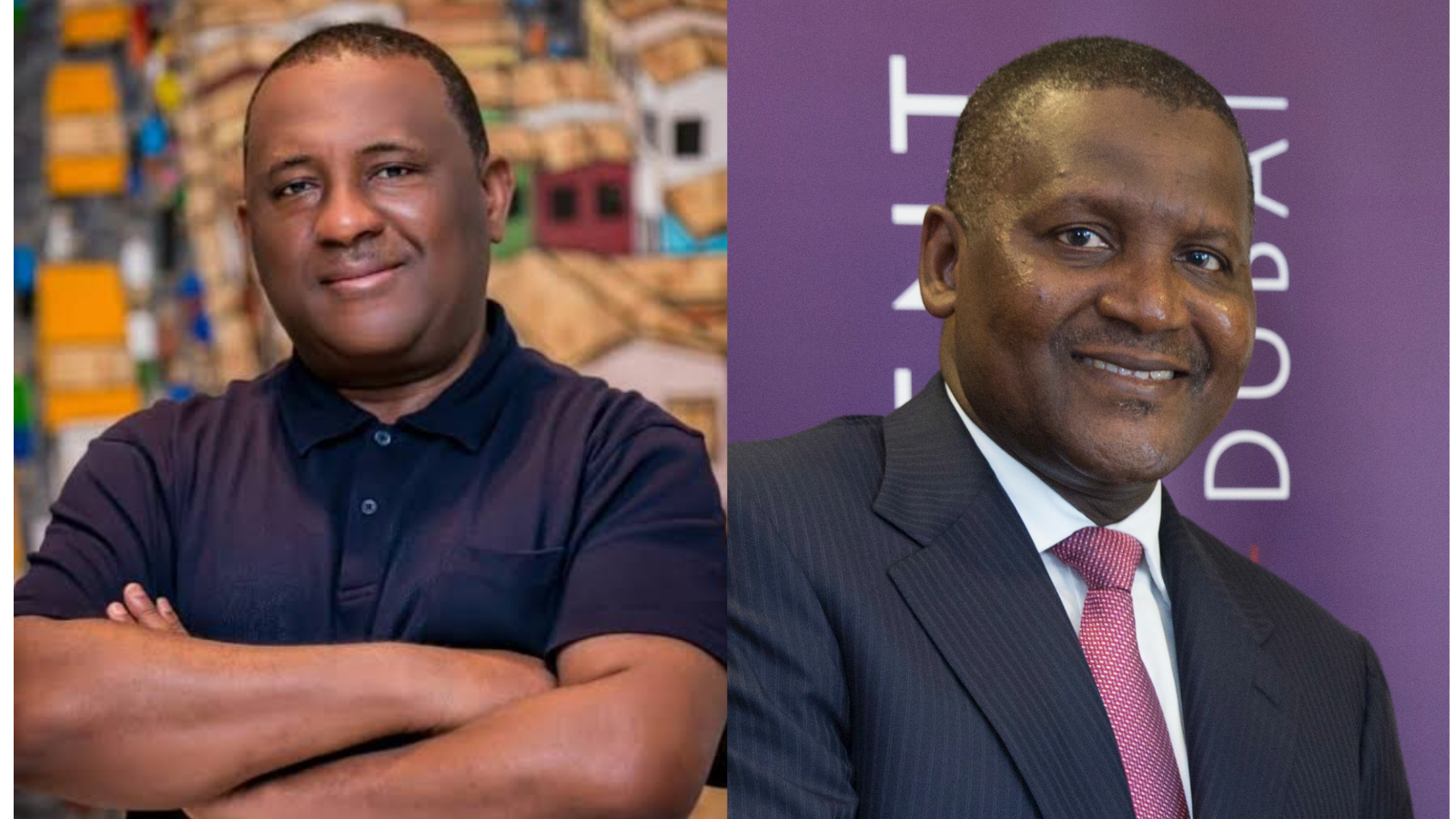

Join our WhatsApp ChannelThis publication learnt that the companies, most especially Dangote Cement and BUA Cement, owned by Aliko Dangote and Rabiu Abdulsamad respectively, are losing a significant part of their revenue to the cost of making the cement available in the market.

While the cement sector’s revenue grew by 21.64 per cent, the cost of production rose higher by 23.86 per cent, as the three companies spent N1.03 trillion to cover the cost of sales in 2022, against the N837.91 billion used the year before.

This impacted the market’s profit after tax which posted N678.66 billion bottom line last year. This fell short of the N679.44 billion net profit earned in 2021.

The financial statements of Dangote Cement, BUA Cement and Lafarge were used to determine the cement sector’s earnings, as only the three companies are publicly listed, which enables Prime Business Africa to access their financial records.

Prime Business Africa’s best-performing firm is based on revenue growth.

How the three companies perform

BUA Cement

BUA Cement recorded the highest revenue and profit after tax in 2022, as the former grew by 40.28 per cent and the latter rose by 12.14 per cent – despite recording the highest increase in the cost of sales, which was 45.13 per cent.

The company reported that its gross revenue for last year was N360.98 billion, surpassing the N257.32 billion recorded in 2021.

In the same vein, BUA Cement’s cost of production hit N197.94 billion in 2022, rising from N136.39 billion spent by the manufacturer the preceding year.

It still managed to squeeze the N101.01 billion profit after tax last year, ending the year with 12.14 per cent more than the N90.07 billion generated as net profit in 2021.

Lafarge Cement

Lafarge raised its revenue by 27.35 per cent, the second highest in the cement industry, closing last year with N373.24 billion, which is above the N293.08 billion turnover posted in 2021.

The company continued its impressive run in 2022 with 5.18 per cent growth in net profit, which grew to N53.64 billion, doing better than the N51 billion profit after tax of the year before.

This is despite reporting a 17.62 per cent increase in expenses to make its products available last year when the cost of production gulped N177.02 billion, above the N150.50 spent in 2021.

Dangote Cement

The cement company owned by the richest man in Nigeria and Africa reported the highest revenue in the sector last year, generating N1.61 trillion, which is 16.96 per cent above the N1.38 trillion grossed in 2021.

However, much of this revenue was lost to production costs which grew by 20.30 per cent in 2022, as Dangote Cement spent N662.89 billion, compared to the N551.01 billion expenses recorded the preceding year.

This weighed heavily on its net profit which slumped by –2.67 per cent to N524 billion last year, failing to surpass the N538.36 billion recorded in 2021 – making Dangote Cement the only publicly-listed cement firm to report a drop in the bottom line.

Follow Us