THE Federal Inland Revenue Service (FIRS) has commenced collection of income tax on bonds, short-term government securities.

In a public notice issued by FIRS it said the decision followed the expiration of an order given by Federal Government dated January 2, 2012 which had exempted Companies Income Tax (CIT) from bonds and short-term securities in the past 10 years.

The federal government had in 2012 granted tax exemption on all bonds and short-term government securities for a period of 10 years.

Join our WhatsApp ChannelFIRS in the notice signed by the Executive Chairman, FIRS, Muhammad Nami, stated that the waiver has expired on 1st January, 2022 and informed the taxpaying public that profits from those previous exemptions are now included in income tax to be paid effective from 2nd January, 2022.

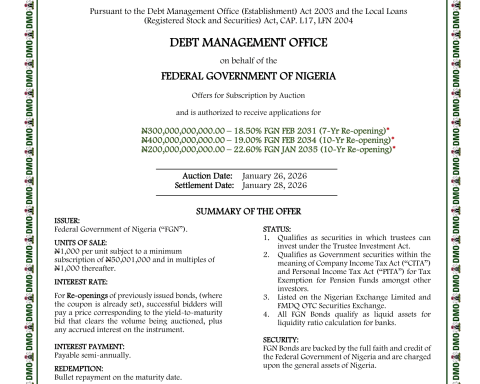

The statement reads, “The Federal Government by an Order dated 2nd January 2012 exempted bonds and short-term Government Securities from income tax for a period of 10 years. The exemption expired on 1st January 2022, except for Bonds Issued by Federal Government.

“Consequently, the taxpaying public is hereby invited to note that income tax applies to income derived by companies from bonds and short-term securities effective from 2nd January 2022, except for Bonds Issued by Federal Government.

“Taxpayers are therefore expected to comply with the law by including such income in the self- assessment returns and tax computation of companies and paying appropriate taxes.”

The agency urged taxpayers to comply with the law by including such income in the self-assessment returns and tax computations of companies and paying appropriate taxes.

It further stated that, “agents of collection of withholding taxes (WHT) are to note the above for deduction of WHT on interest and other payments made to any company on account of income from bonds and other securities.

“For clarity, such bonds and short-term securities on which tax is due effective from 2nd January 2022 include:

(i) Short term Federal Government of Nigeria Securities, such as Treasury Bills and Promissory Notes;

(ii) Bonds Issued by State and Local Governments and their Agencies;

(iii) Bonds issued by corporate bodies including supra-nationals; and

(iv) Interest earned by holders of the Bond and Securities mentioned in paragraph (i) to (iii) above.”