The Minister of Finance, Zainab Ahmed, has revealed why the administration of President Muhammadu Buhari chose to delay the removal of fuel subsidy until the next administration.

President Buhari had scheduled fuel subsidy removal for January 2022, but it was later postponed for 18 months, with the government slating June 2023 for the removal.

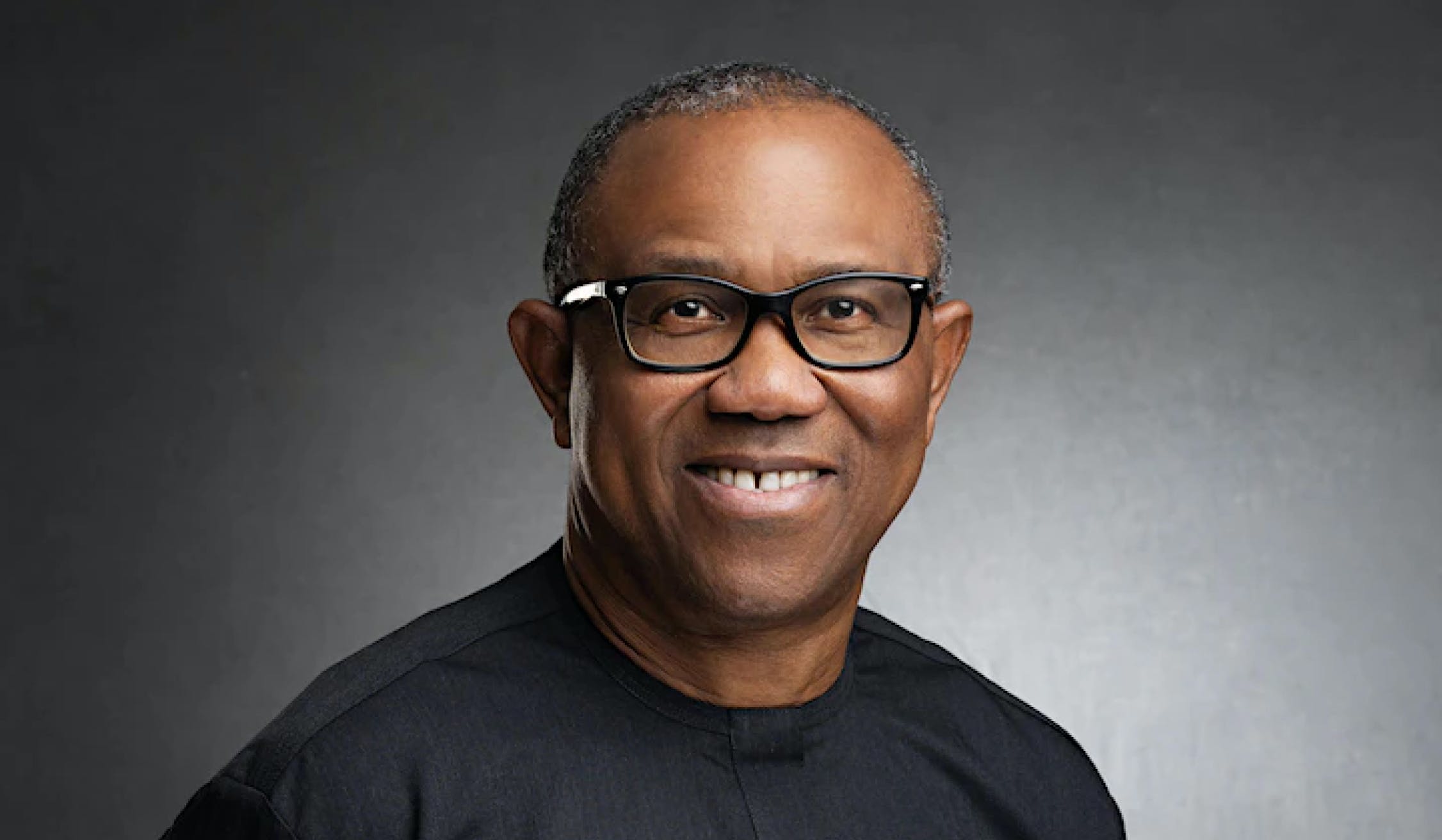

Join our WhatsApp ChannelThis move shifts the responsibility to remove the fuel subsidy, which has gulped trillions of naira to the winner of the Presidential election between Peter Obi, Bola Ahmed Tinubu and Atiku Abubakar, as Buhari’s administration will end in May 2023.

Revealing why President Buhari didn’t remove fuel subsidy during his administration or January 2022 as initially planned, the finance minister stated he didn’t want to add to the burden of Nigerians.

“Removal of fuel subsidy at that time would have increased the burden on the citizens, and the President does not want to contemplate a situation where measures are taken that further burdens the citizenry,” Ahmed said during an interview with Arise TV on the sideline of the World Economic Forum in Davos, Switzerland, on Tuesday.

The minister further stated: “So the decision was to extend the period from June 2022 to 18 months, beginning from January 2022. So in June 2023, we should be able to exit. The good thing is that we hear a consistent message that everybody is saying this thing needs to go and that it is not serving the majority of Nigerians.

“I listened to some of the new leaders campaigning for the next round of leadership in the country and they are saying they will get rid of it very quickly.”

In 12 months of this year, the Nigerian government will spend N6.7 trillion on petrol subsidy payments if it doesn’t remove subsidy. In the first half of this year, FG will pay N3.25 trillion to bring fuel into the country.

Ahmed explained that the removal is important because the federal government always have to borrow to import Premium Motor Spirit (PMS) into the country.

Ahmed said when there’s no money, the government resort to debt. As a result, the country’s debt is piling up on the back of fuel subsidy.

Speaking about the impact of fuel subsidy on the government Ahmed said: “We also have to exit fuel subsidy, because that is also a very significant contributory factor.

“You can look at it in two ways – it is revenue that would have come to the government but it doesn’t because it has been spent on fuel subsidy.”

“But also, where there is nothing for the government to buy the refined petroleum products, we have to borrow to buy the petroleum products. So if you take that out, that’s about N3.25 trillion, that is a significant relief,” the minister added.