NEITI Report Shows Slight Increase in FAAC Allocations

The Federation Accounts Allocation Committee (FAAC) has disbursed N3.473 trillion to the federal, states, and local governments in the second quarter of 2024, reflecting a 1.42% increase compared to the first quarter.

This information was disclosed in the latest quarterly report from the Nigeria Extractive Industries Transparency Initiative (NEITI), led by Orji Ogbonnaya Orji.

Join our WhatsApp ChannelBreakdown of Allocations

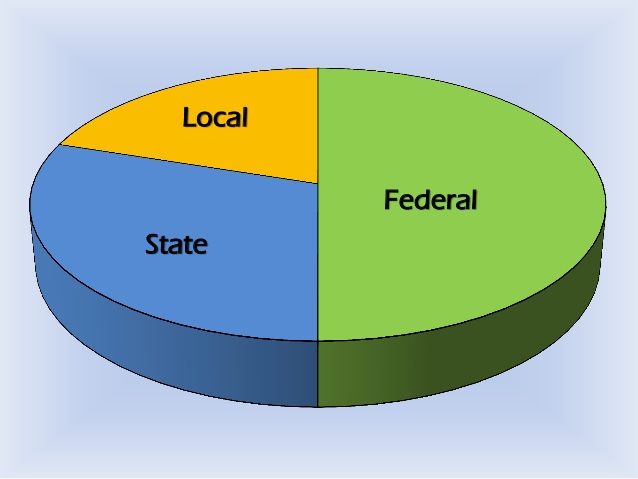

The disbursement breakdown shows that the Federal Government received N1.102 trillion, accounting for 33.35% of the total allocation. The 36 states received N1.337 trillion (40.47%), while local government councils shared N864.98 billion (26.18%).

In addition, nine oil-producing states received N169.26 billion in derivation revenue. However, the Federal Government’s allocation dropped by N41.44 billion (3.76%) compared to Q1, while states and local councils saw an increase of N58.13 billion (4.29%) and N30.82 billion (3.57%), respectively.

Orji on Public Accountability

Speaking on the importance of public accountability, NEITI’s Executive Secretary Orji Ogbonnaya Orji emphasized the role of citizens and civil society organizations in monitoring these allocations.

READ ALSO: Federal, States, Local Govts Share N1,358trn Revenue For July- FAAC

“The ultimate goal of this disclosure is to enhance knowledge, increase awareness, and promote public accountability in the management of public finances,” Orji stated.

He also encouraged citizens to show interest in budget tracking, especially in monitoring disbursements to the various tiers of government.

Key Revenue Contributors to FAAC

The report highlighted the key contributors to the FAAC pool, with the Nigeria Upstream Petroleum Regulatory Commission (NUPRC), the Federal Inland Revenue Service (FIRS), and the Nigeria Customs Service (NCS) leading the charge.

Their contributions came from oil and gas royalties, petroleum profit tax, company income tax, value-added tax, and customs duties.

Orji noted that these contributions were essential to ensuring steady revenue flow into the Federation Account. “Our agencies are working tirelessly to ensure that all revenue sources are maximized for the benefit of the Nigerian people,” he added.

State-by-State FAAC Allocations

Delta State emerged as the top beneficiary of FAAC allocations in Q2 2024, receiving N137.357 billion. Lagos State followed with N123.282 billion, while Rivers State was third with N108.104 billion. Nasarawa, Ebonyi, and Ekiti received the least allocations, all below N25 billion.

Among local governments, Alimosho in Lagos State got the highest allocation with N5.721 billion, followed by Ajeromi/Ifelodun (N4.592 billion). In contrast, Ifedayo local government received the smallest share at N661.82 million.

Derivation Revenue and Oil-Producing States

The nine oil-producing states received 13% of oil-derived revenue. Delta led the way with a 40.153% share, while Bayelsa and Akwa Ibom followed with 38.112% and 36.117%, respectively. Solid minerals-producing states did not receive any derivation revenue in Q2 2024 due to low revenue generation in that sector.

Debt Deductions

Bauchi State had the highest debt deductions in the second quarter of 2024, with N6.49 billion, while Anambra State had the lowest at N115.6 million. Interestingly, Lagos and Nasarawa recorded no debt deductions for the quarter.

Recommendations for Enhancing Revenue and Accountability

NEITI’s report called on states to take advantage of ongoing reforms in the solid minerals sector to diversify their revenue sources. It also urged the Central Bank of Nigeria (CBN) to stabilise the exchange rate to minimize fluctuations in Federation Account remittances.

Additionally, NEITI recommended that the Revenue Mobilisation Allocation and Fiscal Commission (RMFAC) and the Office of the Accountant General of the Federation (OAGF) increase transparency in the payment of special revenue accruals, including derivation arrears and debt repayment refunds.

Orji emphasised, “Transparency is key in ensuring that public funds are used efficiently. We must work together to hold the system accountable.”