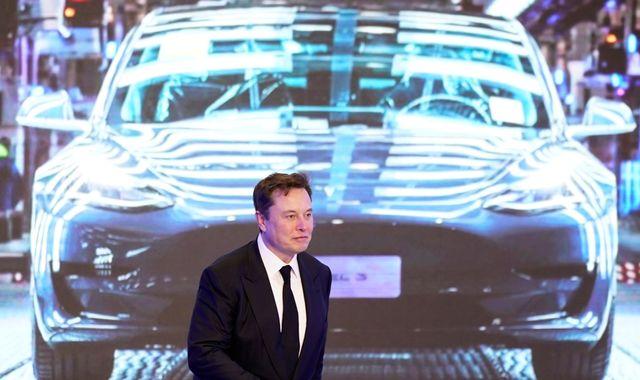

Tesla investors reacted negatively in response to reports that Elon Musk sold some shares he holds in the electric vehicle producer, and this affected the billionaire’s wealth.

Musk had submitted a document to the United States Securities and Exchange Commission (SEC) on Tuesday that he sold 19.5 million Tesla shares to take out $4 billion from his investment in the firm.

Join our WhatsApp ChannelTesla’s stock market performance on the same day showed investors were unhappy following the news, as this Musk’s has sold about $20 billion worth of shares this year due his bid to acquire Twitter.

He had sold around $15 billion in April and August, taking out $8.4 billion and $6.9 billion respectively. Despite stating that he would no longer sell shares, the billionaire reported on Tuesday that he sold another $4 billion worth of shares.

After reports circulated of Musk’s share dealings in the United States’ stock market, investors also dumped Tesla shares in response to his decision.

This led to a -2.93 per cent devaluation of Tesla share from Monday’s close of $197.08 to $191.30 at the end of trading on November 8.

Prime Business Africa gathered that the sell off by Tesla shareholders affected Musk’s networth, which fell below $200 billion to $197.4 billion.

Musk’s wealth was down by -1.94 per cent a day after investors dumped Tesla’s shares, causing the billionaire to lose a whopping N1.73 trillion ($3.9 billion).

Meanwhile, Musk’s decision to add the control of Twitter to his management roles might be a bother to Tesla investors at a time the carmaker is in production.

Musk currently manages Tesla, SpaceX, Starlink, The Boring Company, and now Twitter. There are claims that the roles might overwhelm him, and this will have a negative impact on Tesla’s output.

The concern could be traced to Tesla’s stock performance this year, with the share of the electric vehicle already down by -52.17 per cent year-to-date, from $208.63.

Of late, most of his tweets have been centered on Twitter’s affairs, where he is struggling to keep advertisers who are cutting Twitter off their ads budget, and this has significantly affected the firm’s earnings, as it depends largely on ads.

Also, Musk had fired some Twitter employees, with plan to sack about 3,500 workers to cut down on expenses, after disclosing that the company loses $4 million per day due to its 7,000 workforce.