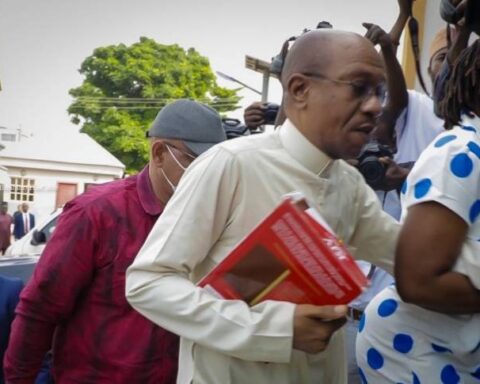

In a turn of events, the Economic and Financial Crimes Commission (EFCC) launched a crackdown on Bureau de Change (BDC) operators, sending shockwaves through the financial markets.

The operation aimed to apprehend both sellers and buyers of forex, raising questions about the motives behind this sudden move.

Join our WhatsApp ChannelThe turmoil unfolded following a purported suspension of forex trading by the Association of Bureau de Change Operators of Nigeria (ABCON), a claim later denied by ABCON President, Dr. Aminu Gwadabe. In a written statement, he clarified that the misinformation was baseless and urged members to continue operations within the regulatory guidelines set by the Central Bank of Nigeria (CBN).

The confusion among BDC operators was exacerbated by frustrations over the widening gap between the official exchange rate and the rates they could offer. Concerns about potential business closures prompted the union to briefly shut down on Thursday, only to face the swift intervention of EFCC officials in Wuse Zone 4.

READ ALSO: Nigeria’s Forex Crisis Rooted In Weak Industrial Capacity – LCCI

Mallam Ibrahim, a BDC operator, highlighted the challenges faced by the union, expressing worries about the diminishing profit margins due to the official exchange rate catching up. The closure, albeit temporary, created a momentary lull in the streets around the Forex market, while transactions continued discreetly behind closed doors.

The rate volatility became evident as Ibrahim reported a drastic drop in the exchange rate to N1,450 per dollar by 4:30 pm on Thursday. The situation was further complicated as some traders resorted to operating from within banking halls, receiving dollars in their accounts and transferring the Naira equivalent.

The unfolding events suggest a potential shift in the dynamics of the Nigerian foreign exchange market. The narrowing gap between official and black market rates, driven by various economic factors, challenges the traditional dominance of black market operators. This could signal increased confidence in the official market, potentially reducing the demand for alternative channels.

The impact of the BDC closure, even if temporary, could have significant repercussions for individuals and businesses relying on unofficial channels for foreign exchange. While access to official channels remains limited for many Nigerians, the sudden shutdown poses challenges for those dependent on the black market.

As the situation unfolds, both the CBN and ABCON are yet to issue official statements, leaving the long-term implications of the traders’ closure uncertain. The fluid nature of these developments underscores the need for vigilance in monitoring the evolving landscape of Nigeria’s foreign exchange market.