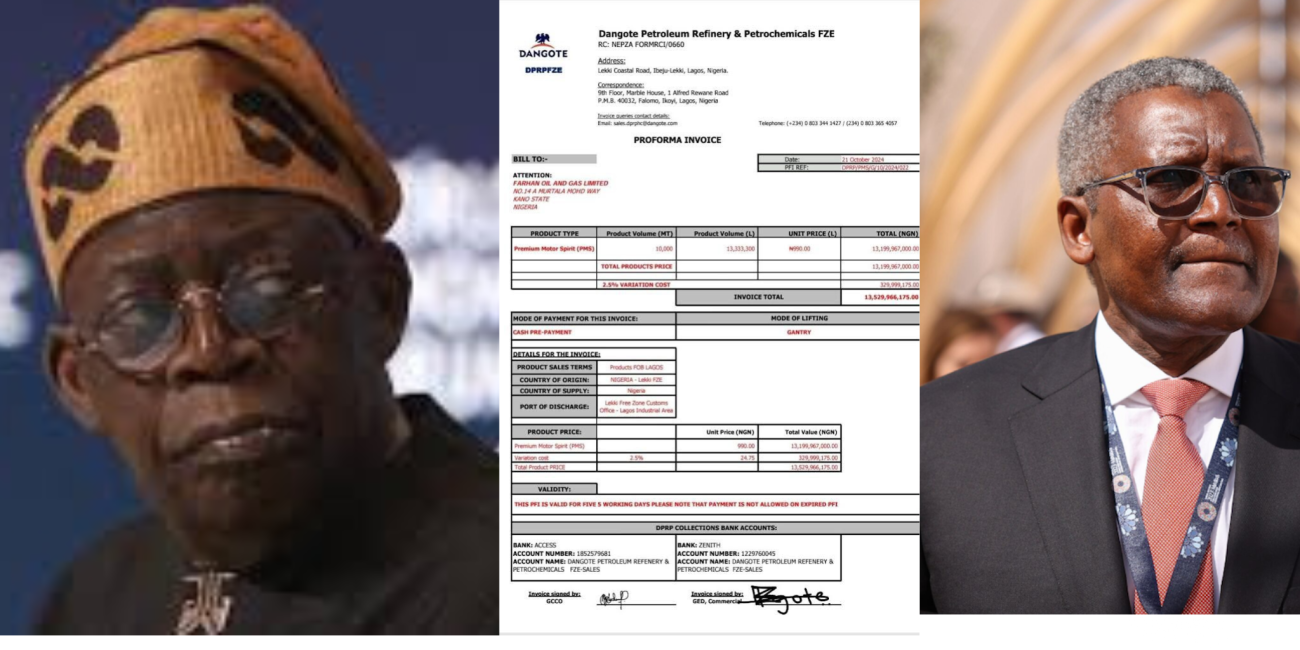

Dangote’s Fuel Supply and Pricing Raises Questions in Nigeria’s Oil Market

Billionaire industrialist, Aliko Dangote, reportedly misled President Ahmed Tinubu about having 500 million litres of fuel in storage.

Despite this claim, Dangote is said to be pushing the Nigerian National Petroleum Company (NNPC) to buy his petrol at ₦990 per litre, with private depot owners struggling to compete under these terms.

Join our WhatsApp ChannelIn the latest news regarding Nigeria’s fuel industry, the African richest man has come under scrutiny for allegedly misleading President Bola Ahmed Tinubu on the extent of his fuel storage capacity.

This development, which involves significant pricing issues at Dangote’s refinery, has stirred concerns among private depot owners and other industry stakeholders.

500 Million Litres Alleged Claim

According to sources who spoke to Sahara Reporters, Dangote claimed in a recent meeting with President Tinubu to have 500 million litres of fuel stored, indicating substantial stock available for market needs. However, sources assert that this number may not align with the actual storage, fuelling debate over transparency.

“Dangote informed the President that he had 500 million litres of fuel in storage,” one source told Sahara Reporters. “But it seems the numbers don’t match up with what’s actually available. This led to the perception that the President was misled.”

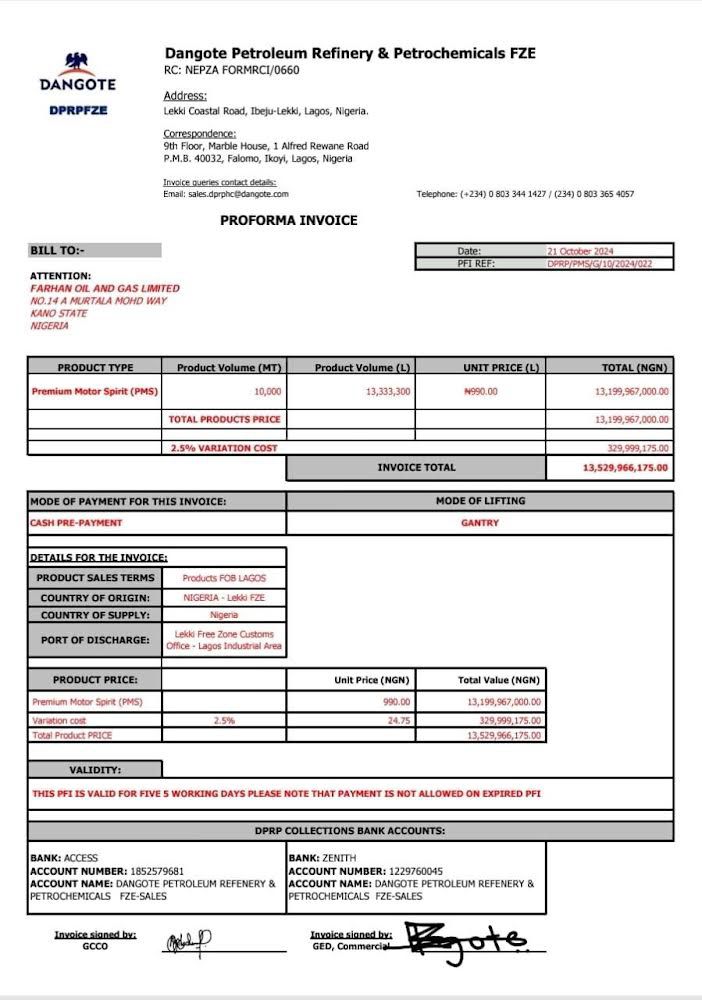

The source further explained that Dangote’s price per litre, set at ₦990, comes with a high minimum purchase requirement of 1 million litres, all payable in advance. This pricing model has reportedly excluded independent petroleum marketers, who struggle to afford such upfront payments, impacting their ability to distribute fuel.

High Costs Keep Private Depot Owners Out

One of the primary reasons for discontent among private depot owners is the high cost of loading and additional expenses, such as port fees and chartering, which make Dangote’s fuel offerings financially unfeasible for many.

“If you’re buying with a vessel, the minimum purchase is 15,000 metric tonnes, which is around 20 million litres at ₦971 per litre,” shared another source. “By the time port and discharge costs are added, the cost for private depot owners lands at around ₦1,031 per litre. That’s why many aren’t buying.”

This issue has led to calls from stakeholders, including private investor Femi Otedola, for private depot owners to consider selling their assets as scrap, given their inability to compete with Dangote’s pricing structure. “Otedola has even suggested that some depot owners might be better off scrapping their facilities,” the source disclosed.

READ ALSO: Nigerians Question Dangote Refinery’s N990 Price As Fuel Hardship Deepens

NNPC’s Role in Market Dynamics

A critical player in this equation is the Nigerian National Petroleum Company (NNPC) Limited, which Dangote reportedly urged President Tinubu to compel to purchase fuel from his refinery. However, Tinubu is said to have declined this push for exclusivity, indicating that NNPC would only make purchases if the pricing was reasonable and aligned with market needs.

“Dangote wanted the President to make NNPC buy from his refinery, but the President was clear: NNPC should be treated like any other company,” a source explained. “NNPC is focused on balancing cost and profit to keep prices fair for consumers.”

Afreximbank’s Involvement and Potential Foreign Exchange Challenges

The meeting between Dangote and President Tinubu was attended by representatives from the African Export–Import Bank (Afreximbank), which reportedly has private investments tied to Dangote’s refinery. Dr. Benedict Oramah, Afreximbank’s President, is said to be involved in discussions concerning the refinery’s operations.

“They are putting pressure on NNPC to provide foreign exchange subsidies to Dangote, which NNPC is currently resisting,” revealed another insider. This push for subsidies could place additional financial demands on the government, sparking concerns over potential monopolistic tendencies in the market.

President Tinubu Pushes Back on Subsidy Requests

During the discussions, President Tinubu reportedly declined Dangote’s request to fix the naira-to-dollar exchange rate for fuel purchases, emphasising market-driven pricing instead. This stance aligns with Tinubu’s broader economic policies, aimed at reducing Nigeria’s dependency on subsidies while creating a more competitive market.

“Dangote asked the President to set the exchange rate, but Tinubu was clear: no special treatment,” a source shared. “This decision highlights the President’s commitment to fair practices in the industry.”

Concerns Over Monopoly and Market Balance

While Dangote’s refinery holds the potential to meet Nigeria’s fuel demand, industry experts worry that such market dominance could lead to monopolistic behaviour, driving smaller players out. With rising costs, high entry barriers, and Dangote’s strategic positioning, stakeholders are raising alarms over the potential impact on competition.

“Dangote’s target seems to be securing a monopoly, especially since the subsidy has been removed. But President Tinubu’s approach aims to prevent this and ensure competitive practices,” said a source familiar with the discussions.

As Nigeria’s fuel market continues to evolve, the dynamics between major industry players, private depot owners, and the government will be essential in shaping a stable and fair energy landscape. Dangote’s role remains crucial, but the unfolding debate highlights the importance of regulatory oversight to maintain market balance and protect consumer interests.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

Follow Us