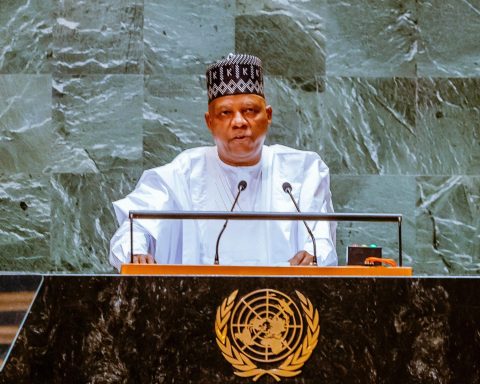

Dr. Marcel Mbamalu

The Central Bank of Nigeria’s recent directive to geo-tag all Point of Sale (POS) machines to a 10-meter accuracy has sparked concerns about the impact on financial inclusion, particularly in rural areas and informal communities. While the move aims to tackle fraud and misuse in the digital payment space, it may inadvertently strain fintech startups, local vendors, and millions of consumers who rely on POS services.

Join our WhatsApp ChannelIn a circular signed by Dr Rakiya O. Yusuf, Director of the Payments System Supervision Department, the CBN recently directed that all Point of Sale (POS) machines be geo-tagged to a 10-metre accuracy. The move is aimed at tackling fraud and misuse in the digital payment space, to secure transactions, protect consumers, and improve accountability.

For many Nigerians, POS operators are the main gateway to financial services, filling gaps left by weak banking infrastructure and limited branch networks. Now, they face new regulatory hurdles without clear support from the regulator.

Will the 60-day deadline not overwhelm small businesses, especially in rural areas with poor internet and GPS? For many Nigerians, the real threat is not POS fraud, but the terrorists chasing citizens from farmlands.

Hence, the policy overlooks the realities faced by operators and Nigerians who rely on POS services, as it risks straining fintech startups, local vendors, and millions of consumers, even as banks, under the CBN’s watch, have failed to provide consistent services.

Since the cashless policy and chaotic currency redesign that left old notes still in circulation, banks and ATMs have continued to disappoint, but no such obligations have been placed on them.

POS, an inseparable tool from the naira redesign

Point of Sale (POS) devices in Nigeria are tied to the Central Bank of Nigeria’s (CBN) cashless policy aimed at reducing cash in circulation, curbing fraud, and driving digital payments. The 2022–2023 naira redesign triggered a severe cash crunch before the general elections. A Premise survey found 57% of Nigerians considered the shortage more important than the polls, while NOIPolls estimated that about 43.7 million adults (41%) had not physically seen the new notes months after launch.

In the vacuum, POS agents expanded rapidly, often raising fees to meet demand. The old ₦1,000, ₦500, and ₦200 notes remain legal tender, a status the CBN reaffirmed in December 2023. Banks had promised easier access to services, but in reality, Nigerians endured long queues, poor networks, and poor service delivery.

This opened space for fintech innovators. Platforms such as Opay, PalmPay, and Moniepoint offered faster, reliable transfers and drove the spread of POS machines. Once confined to urban centres, POS devices soon became ubiquitous. For many Nigerians, visiting a bank today is mainly for opening accounts or customer service, as POS terminals and mobile platforms handle daily transactions.

Even small businesses in markets and roadside stalls now rely on POS services not just for card payments but also to receive transfers in cash-dominant sectors. The surge in POS adoption is more than a technology trend; it is a survival strategy for millions who depend on fast, seamless transactions to keep their livelihoods afloat.

In rural areas, the shift has been transformative. Many LGAs still lack bank branches or suffer from weak network infrastructure, making access to formal banking difficult. POS terminals fill this gap, acting as mini-branches that provide basic services in remote communities. Persistent ATM cash shortages have also frustrated customers, but POS devices offer a practical alternative, enabling seamless transactions without depending solely on cash withdrawals. The ubniquity of POS also meant light employment for millions of jobless youth, many of them university graduates.

What is Geo-tagging

Geo-tagging means fixing each POS to a precise location within a 10-metre radius, ensuring transactions are traceable and preventing fraudsters from moving devices undetected.

While simple in theory, is it not impractical in a country where mobility is a survival strategy? Many operators lack fixed shops and move between markets and events to reach customers. The policy raises dilemmas: if an agent registered in Abuja travels to Lagos, does the machine become useless? Must every move require re-tagging? Such rigidity threatens the very flexibility that sustains millions of small businesses and informal vendors

Stakeholders Affected: Who Bears the Brunt of the Geo-Tagging Directive?

The geo-tagging policy is more than a technical tweak; it strikes at the heart of Nigeria’s digital payments, raising urgent questions of cost, survival, and service continuity for fintechs, vendors, and everyday users.

Big players like Opay, PalmPay, and Moniepoint have invested heavily in millions of POS terminals, but now face the nightmare of recalling and re-registering devices within 60 days. Who bears this cost: firms, vendors, or end users? If pushed down the chain, it risks slowing growth and eroding consumer trust.

For millions of young Nigerians, POS services are lifelines, not just side hustles. Operators bridge gaps where banks have failed, yet rigid location rules threaten shutdowns, sanctions, and costs they cannot absorb.

With no support structure, many may be forced out of business. Ordinary citizens, already abandoned by banks closing branches and rationing cash, rely on POS for deposits, withdrawals, and transfers.

Disruption will hit the poor hardest. In rural and informal communities, people often withdraw as little as N500 from POS agents without humiliation, or turn to them after getting off a bus to avoid embarrassment. At stake is not just convenience but the promise of financial inclusion.

The Wider fears

Beyond the operational challenge lies a deeper concern: government policies often stifle grassroots survival strategies instead of supporting them.

This is not new. Bans on okada and keke riders, imposed in the name of security, ignored the millions who depend on these informal businesses to survive, while insecurity persists because thieves remain thieves, a problem for security agents to solve, not businesses to bear.

Multiple taxes on solar panels and generators punish low-income households and small businesses seeking alternatives to power shortages. Petty farmers, who feed the nation, face neglect, policy inconsistency, and worsening insecurity, as many former riders turn to kidnapping.

The paradox is glaring. While the government laments rising internet fraud among idle youth, its policies often restrict legitimate means of survival. The geo-tagging directive, framed as security, feels instead like another clampdown on informal hustlers in a hostile economy, more punishment than reform, and less about inclusive growth than regulation for its own sake.

As the deadline looms, unanswered questions deepen the anxiety of fintechs, POS operators, and consumers. What exactly is the timeline? While the CBN initially gave 60 days, will there be extensions or phased implementation? How transparent will the process be? Operators need clarity on how geo-tagging data will be collected, verified, and secured.

Will fintechs and POS agents be consulted, since they know the practical challenges best? And how will service disruptions be avoided in communities where millions rely daily on POS terminals as their only access to cash?

Financial innovation must be regulated to prevent fraud, but regulation should not strangle the same systems that sustain millions.

The CBN faces the urgent task of balancing fraud prevention with economic reality. Banks, which supply POS machines, must employ more staff to manage new demands. And if informal operators lose their livelihoods without alternatives, more young Nigerians may turn to cybercrime out of desperation.

For the geo-tagging directive to work, the government must enforce it with care, transparency, and support, tackling the root causes of fraud while protecting fragile income streams. Anything less risks worsening unemployment and widening the dangerous trust gap between citizens and authorities. Building a stronger economy and creating jobs will solve crime far more than indirect interferences in petty survival strategies of jobless youth. Crime had spiralled out of control long before the POS boom.

Dr. Marcel Mbamalu is a distinguished communication scholar, journalist, and entrepreneur with three decades of experience in the media industry. He holds a Ph.D. in Mass Communication from the University of Nigeria, Nsukka, and serves as the publisher of Prime Business Africa, a renowned multimedia news platform catering to Nigeria and Africa's socio-economic needs.

Dr. Mbamalu's journalism career spans over two decades, during which he honed his skills at The Guardian Newspaper, rising to the position of senior editor. Notably, between 2018 and 2023, he collaborated with the World Health Organization (WHO) in Northeast Nigeria, training senior journalists on conflict reporting and health journalism.

Dr. Mbamalu's expertise has earned him international recognition. He was the sole African representative at the 2023 Jefferson Fellowship program, participating in a study tour of the United States and Asia (Japan and Hong Kong) on inclusion, income gaps, and migration issues.

In 2020, he was part of a global media team that covered the United States presidential election.

Dr. Mbamalu has attended prestigious media trainings, including the Bloomberg Financial Journalism Training and the Reuters/AfDB Training on "Effective Coverage of Infrastructural Development in Africa."

As a columnist for The Punch Newspaper, with insightful articles published in other prominent Nigerian dailies, including ThisDay, Leadership, The Sun, and The Guardian, Dr. Mbamalu regularly provides in-depth analysis on socio-political and economic issues.