The Central Bank of Nigeria has announced the successful clearance of all valid foreign exchange (Forex) backlogs, marking a significant milestone in the nation’s economic journey.

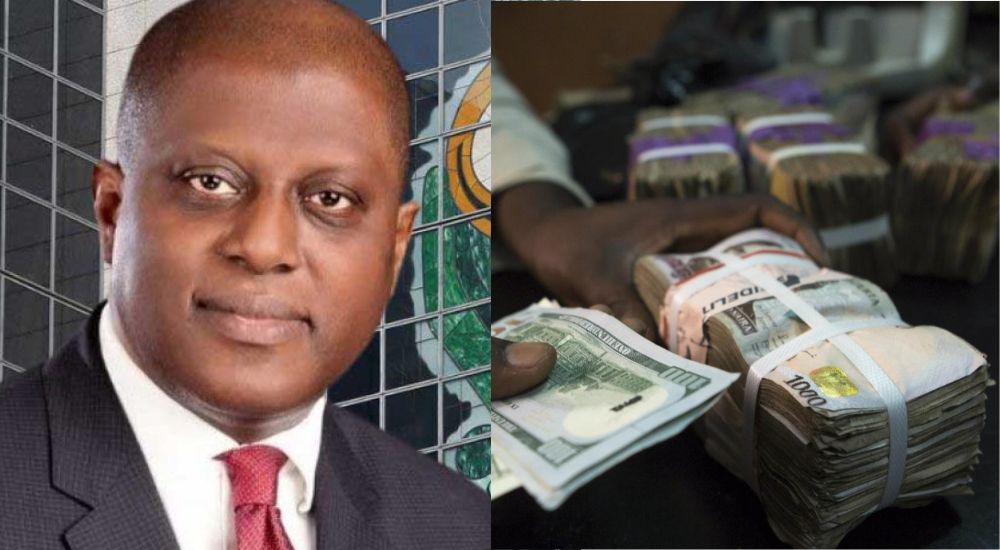

This accomplishment fulfills a commitment made by CBN Governor, Mr Olayemi Cardoso, to address an inherited backlog of $7bn in claims.

Join our WhatsApp ChannelIn a statement delivered by the bank’s Acting Director of Corporate Communications, Mrs Sidi Ali, meticulous efforts were highlighted in settling outstanding transactions.

Ali emphasized, “We needed to go through an independent and credible process that would determine the authenticity of those obligations, and, at this point, I can tell you that we have now cleared all genuine, verifiable transactions.”

The clearance of the foreign exchange transactions backlog aligns with the strategy outlined during last month’s Monetary Policy Committee meeting, aimed at stabilizing the exchange rate and mitigating imported inflation.

READ ALSO: Governor Obaseki Urges Fiscal Policies To Combat Forex Crisis

Cardoso reiterated the importance of this move, stating, “This encumbrance to market confidence in the country’s ability to meet its obligations is now totally behind us.”

The increase in external reserves, reaching $34.11bn as of March 7, 2024, further underscores the positive trajectory. This rise was attributed to increased remittance payments by Nigerians overseas and higher purchases of local assets by foreign investors.

The apex bank ensured a rigorous process, with independent auditors from Deloitte Consulting assessing each transaction to honor only legitimate claims. Notably, the recent completion of a $1.5bn payment resolved obligations to bank customers, effectively clearing the residual balance of the FX backlog.

Cardoso’s communication with foreign portfolio investors emphasizes sustained increases in Nigeria’s foreign currency reserves and improved liquidity in the foreign exchange market, signaling renewed confidence in the Nigerian economy.

As Nigeria moves forward, the successful clearance of the FX backlog serves as a beacon of confidence for investors and businesses, paving the way for a more resilient and stable economic landscape.

Emmanuel Ochayi is a journalist. He is a graduate of the University of Lagos, School of first choice and the nations pride. Emmanuel is keen on exploring writing angles in different areas, including Business, climate change, politics, Education, and others.

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/

- Emmanuel Ochayihttps://www.primebusiness.africa/author/ochayi/