The Managing Director of BUA Foods, Ayodele Abioye, and the Chief Executive Officer of Lafarge Africa, Khaled El Dokani, lament about the Naira redesign policy of the Central Bank of Nigeria (CBN).

Abioye and El Dokani listed the CBN’s Naira redesign policy as one of the challenges faced during operation in the first quarter of 2023, as it caused a shortage of currency.

Join our WhatsApp ChannelPrime Business Africa previously reported that the CBN implemented the Naira redesign policy on 10 February 2023 to reduce the currency in circulation and improve the security of the Naira notes.

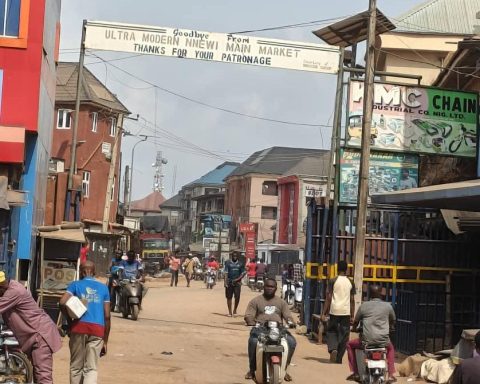

However, the now infamous policy led to a cash crunch, with Nigerians unable to access funds for transactions. This resulted in the sale of the Naira by traders and banking agents, as commercial banks said they don’t have banknotes to disburse.

In response, bank customers attacked some financial institutions, with bankers working in fear and forced to disguise themselves whenever they are going to the office or leaving.

People had no money to buy goods or pay for services, while banks’ digital apps also failed to make transfers, as the digital apps couldn’t handle the migration from cash to online transfers.

Complaining about the challenging business environment in Nigeria in their first quarter financial statements, Abioye said: “BUA Foods Plc continue to deliver strong performance across key financial metrics despite the business climate headwinds characterised in Q1 by the economic impact of the general elections, high food inflation and shortage of cash in circulation following the currency redesign policy.

“We continue to leverage our unique strategic business model to minimise the impact. We are committed to remain the most profitable business in our sector while creating long term values for our stakeholders as we expand our frontiers.”

Also highlighting the challenges faced and noting the impact of the cash crunch on Lafarge’s business: El Dokani, said: “Q1 2023 was a challenging first quarter due to the economic impact of the general elections and shortage of cash in circulation following the currency redesign policy.

“These constrained our financial performance. However, we remain focused on delivering sustainable value to all stakeholders as market recovers post-election and through the rest of the year.

“Lafarge Africa remains committed to accelerating green growth in line with our sustainability ambitions and targets.”