Bureau De Change (BDC) operators have called on the Central Bank of Nigeria (CBN) to extend the recapitalisation deadline and review licence requirements.

The appeal comes as CBN set 3 June 2025 as a deadline for BDC operators to meet the new capital threshold.

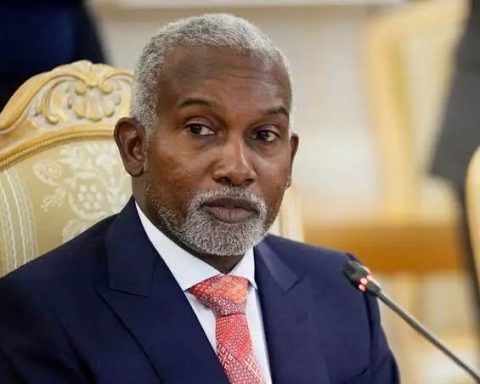

Join our WhatsApp ChannelPresident of the Association of Bureau De Change Operators of Nigeria (ABCON), Aminu Gwadabe, who made the appeal, said implementation of the deadline could lead to loss of jobs across the sector.

Gwadabe, who spoke in an interview with the News Agency of Nigeria (NAN) said although the apex bank had previously given an extension, the majority of BDC operators are finding it difficult to meet the new capital requirement.

Prime Business Africa reports that the CBN had, in May 2024, issued a revised guideline, mandating BDC operators to increase their capital threshold, effective June 3 of the same year.

READ ALSO: CBN Sets New $25,000 Weekly Limit For BDCs To Regulate FX Market

According to the revised guideline, BDCs were classified into tier 1 and tier 2. While those in tier 1 were to have a new capital base of N2 billion, BDC operators in tier 2 need N500 million.

The apex bank also set non-refundable application costs of N5 million and N2 million for tier 1 and tier 2, respectively.

BDC operators were initially granted six months to meet the new capital requirements, and later given a further six months to do so.

However, the ABCON president lamented that “less than 10 percent” of members have met the threshold, putting over three million jobs and livelihoods at risk.

READ ALSO: Naira To Dollar Rate Falls Below N800 In Official Market, BDCs Raise Prices Of USD, Pound, Euro

He said the only way to avert the challenge is the financial regulator to grant a further extension to enable the operators rally round and raise funds to new the new requirement.

Granting the extension, according to the ABCON president, would help to douse the anxiety, pressures, and tension that have engulfed the sector.

“Finally, there is the acceleration of the licensing process to give hope, clarity, and direction to the investors who have met the requirements and the prospective investors.”

Gwadabe disclosed that ABCON has continued to engage the CBN and other relevant agencies to prevent job losses.

“The plans for mergers include identifying like minds in five, 10, 15, 20 entities to come together and float a new entity,” he said.

“As earlier mentioned, we have also applied to the CBN for ‘No Objection’ on our plans to float a public limited liability with the capacity to absorb many of our members but met a holding response from the CBN.”

Just like commercial banks, the recapitalisation policy is part of the CBN’s broader effort to sanitise and strengthen Nigeria’s foreign exchange (FX) market.

Victor Ezeja is a passionate journalist with seven years of experience writing on economy, politics and energy. He holds a Master's degree in Mass Communication.